Introduction to Investing: Fixed Income vs. Stocks

Investing is a foundational element of personal finance and wealth-building. Navigating through diverse investment options can be overwhelming, especially when distinguishing between fixed income assets and stocks. Both investment types offer unique advantages and risks, catering to different financial goals and risk tolerances. This article explores the characteristics, benefits, and drawbacks of fixed income investments and stocks, providing a clear comparison to help investors make informed decisions.

Understanding the Basics of Fixed Income Investments and Stocks

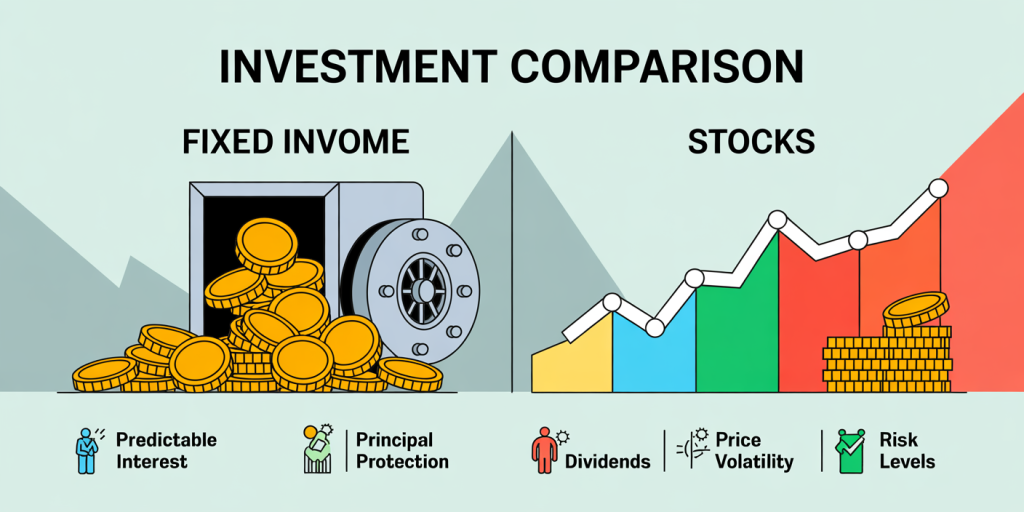

Fixed income securities are investment products that provide returns in the form of regular interest payments and the return of principal upon maturity. Common fixed income instruments include government bonds, corporate bonds, municipal bonds, and certificates of deposit (CDs). These investments are generally considered safer than stocks because they offer predictable income streams and a clear maturity date, minimizing the uncertainties related to price volatility.

Stocks, on the other hand, represent ownership in a company. When you buy stocks, you become a partial owner and share in the company’s profits through dividends and capital appreciation. Stocks tend to be more volatile than fixed income assets because their value depends heavily on company performance, market trends, and economic conditions. However, they also offer greater potential for high returns over the long term.

Risk and Return Profiles: Comparing Fixed Income and Stocks

Risk tolerance is a crucial factor when deciding between fixed income and stock investments. Fixed income securities typically carry lower risk compared to stocks. For example, U.S. Treasury bonds are considered virtually risk-free since they are backed by the federal government. Corporate bonds carry higher risks, especially if the issuer has a lower credit rating, which is reflected in the interest rate offered to investors. According to Morningstar’s 2023 fixed income data, investment-grade bonds yielded an average annual return of approximately 3.5%, while high-yield bonds offered around 6.1% but with increased default risk.

Stocks, conversely, offer no guaranteed returns, and their prices can fluctuate widely. Historical data from the S&P 500 index shows an average annual return of about 10% over the last century, but individual years often experience significant downturns. For example, during the 2008 financial crisis, the S&P 500 tumbled nearly 38%. While stocks can deliver higher long-term gains, their volatility makes them less suitable for risk-averse investors or those needing steady income.

| Feature | Fixed Income | Stocks |

|---|---|---|

| Return Potential | Moderate (3-6% average annual) | High (around 10% average annual) |

| Risk Level | Low to Moderate | Moderate to High |

| Income | Predictable and regular | Dividends are not guaranteed |

| Price Volatility | Low | High |

| Principal Protection | Generally protected if held to maturity | No principal protection |

Income Generation and Capital Growth: How Investments Produce Returns

Fixed income investments primarily generate returns through interest payments, making them attractive to investors seeking steady cash flows. For example, a $10,000 investment in a bond yielding 5% annually can provide $500 in yearly income, which may be ideal for retirees or individuals who prefer predictable income streams. Additionally, if bonds are held to maturity, investors receive the full principal amount back, making it a conservative component of a portfolio.

Stocks generate returns via two main avenues: dividend income and capital gains. Dividend-paying stocks provide income distributions periodically, but these payments can fluctuate or be suspended based on the company’s financial health. Capital gains occur when the stock price appreciates over the purchase price. For instance, Apple Inc. (AAPL) shares have steadily increased in value over the past decade, rewarding shareholders with both dividends and substantial price appreciation. However, dividend yields on stocks tend to be lower than bond yields historically, averaging around 2%.

Investors often balance these features depending on their financial objectives. Younger investors might favor stocks for growth potential, while older investors prioritize fixed income for income and capital preservation.

Tax Implications and Investment Costs

Taxation is an important consideration in choosing between fixed income and stock investments. Interest income from bonds is generally taxed at the investor’s ordinary income tax rate, which can be as high as 37% in the United States depending on your tax bracket. However, municipal bonds offer attractive tax benefits as their interest is often exempt from federal and sometimes state taxes, enhancing after-tax returns for investors in high tax brackets.

Dividend income from stocks is taxed differently. Qualified dividends typically enjoy lower tax rates, ranging from 0% to 20%, depending on income levels, making stocks more tax-efficient under certain scenarios. Additionally, capital gains from selling stocks held longer than one year are taxed at long-term capital gains rates, which are generally lower than ordinary income tax rates.

Investment costs also vary. Bonds may incur broker fees or markups when purchased, but actively managed bond funds have expense ratios that affect net returns. Stocks generally have low transaction fees in today’s discount broker environment. The ongoing costs for stocks depend on whether the investment is through individual shares or managed funds.

Case Study: Building a Balanced Portfolio Using Fixed Income and Stocks

To illustrate the practical application of these asset classes, consider a hypothetical investor named Jane, aged 45, planning for retirement at 65. Jane wishes to build a balanced portfolio that enables moderate growth while managing risk. Based on her moderate risk tolerance, her financial advisor suggests an allocation of 60% stocks and 40% fixed income.

Jane invests in a diversified mix of exchange-traded funds (ETFs): an S&P 500 ETF representing large-cap U.S. stocks for growth potential, and a high-quality bond ETF including U.S. Treasury and corporate bonds for stability and income. Over the past 15 years, her stock allocation yielded an average return of 9%, while her bond allocation returned about 4%.

When the 2020 market downturn occurred due to the COVID-19 pandemic, her bond holdings buffered the portfolio, mitigating losses from stock market volatility. By the time markets recovered, Jane’s portfolio followed an overall upward trend, exemplifying how fixed income and stocks together can stabilize returns and preserve capital.

Future Perspectives: Trends in Fixed Income and Equity Markets

Looking ahead, changes in the economic landscape and technology are shaping both fixed income and stock markets. Rising interest rates, as seen in 2022 and 2023 with central banks tightening monetary policies, have impacted bond prices negatively while increasing yields, making fixed income more attractive for income-seeking investors. Experts believe that bond markets may offer improved returns over the next decade compared to the historically low-yield environment of the previous decade.

Equity markets continue to evolve with innovations such as algorithmic trading, ESG (environmental, social, governance) investing, and increased retail participation via online platforms. These factors create both opportunities and challenges for stock investors. Additionally, sectors like technology, renewable energy, and healthcare are expected to dominate growth, influencing stock market returns.

Investors are advised to maintain a diversified portfolio, regularly review asset allocation, and adjust based on market conditions and personal financial goals. The integration of fixed income and stocks remains a proven strategy for balancing risk and growth in investment portfolios.

—

This comprehensive exploration of fixed income versus stocks highlights the importance of understanding each asset class’s role, benefits, and risks to build a portfolio aligned with individual objectives. By analyzing real-world examples, tax considerations, and future trends, investors can approach investment decisions with greater confidence and clarity.