Real Estate Crowdfunding: How to Get Started

The real estate market has long been a lucrative avenue for investors seeking steady returns and portfolio diversification. Traditionally, investing in real estate required substantial capital, extensive market knowledge, and direct property management, which often limited participation to high-net-worth individuals. However, the rise of real estate crowdfunding platforms has democratized access to this asset class, enabling everyday investors to pool resources and invest in properties without the conventional barriers.

Imagem ilustrativa: A diverse group of everyday investors pooling money together through an online real estate crowdfunding platform, showing digital devices and a variety of residential and commercial properties in the background.

Imagem ilustrativa: Futuristic depiction of blockchain-based real estate crowdfunding with digital tokens, smart contracts, and green sustainable buildings, illustrating the integration of technology, liquidity, and ESG investing trends.

Real estate crowdfunding is a method that aggregates funds from multiple investors to finance property purchases or developments. This investment model harnesses online platforms to streamline the process, reduce entry costs, and improve liquidity compared to direct property ownership. As of 2023, the global real estate crowdfunding market exceeds $14 billion, with projections estimating a compound annual growth rate (CAGR) of around 20% through 2028, according to a report by Grand View Research. This growth reflects growing investor confidence and technological advances making real estate crowdfunding more accessible and transparent.

To make the most of real estate crowdfunding opportunities, it’s essential to understand the fundamentals of how it works, identify suitable platforms, evaluate risks, and select projects strategically. This guide covers the essential steps and insights for beginners ready to start investing in this innovative real estate niche.

Understanding Real Estate Crowdfunding Fundamentals

Investors entering the real estate crowdfunding space need to grasp the fundamental mechanics behind this investment approach. Unlike purchasing a property outright, real estate crowdfunding involves buying shares or interests in a property project alongside other investors. These shares represent partial ownership or debt interests depending on the investment structure.

Two primary crowdfunding models predominate the market: equity crowdfunding and debt crowdfunding. Equity investments provide a share in the property’s ownership and potential appreciation profits, while debt investments function as loans with fixed interest returns, generally considered lower risk.

For example, Fundrise, one of the leading real estate crowdfunding platforms in the U.S., offers both eREITs (equity-based real estate investment trusts) and eFunds that pool money into diversified portfolios. According to Fundrise’s 2022 investor update, their average annual returns ranged from 8% to 12%, depending on the investment vehicle chosen, showcasing the potential profitability of crowdfunding mechanisms.

Understanding these investment types enables investors to align their risk tolerance and investment goals effectively.

Selecting the Right Real Estate Crowdfunding Platform

Choosing an appropriate platform is a foundational step in launching a successful real estate crowdfunding investment journey. Factors to consider include platform reputation, types of projects offered, minimum investment requirements, fees, and transparency.

Popular platforms include Fundrise, RealtyMogul, CrowdStreet, and DiversyFund. Each varies in its investor requirements, project focus, and fee structures. For instance, CrowdStreet specializes in commercial real estate and typically targets accredited investors with minimum investments often starting at $25,000, whereas Fundrise caters to non-accredited investors with minimums as low as $500.

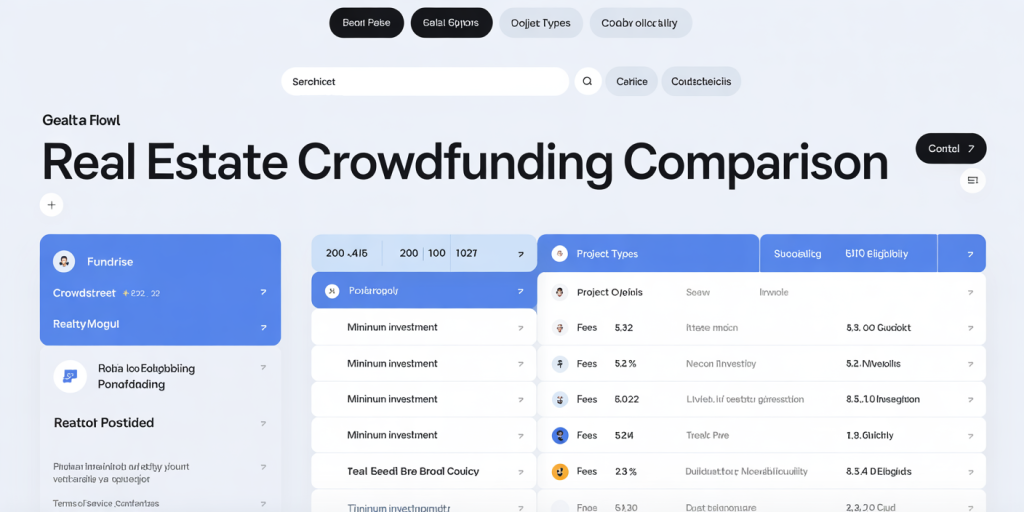

Imagem ilustrativa: A detailed comparison chart or dashboard displaying features of popular real estate crowdfunding platforms (like Fundrise, CrowdStreet), highlighting minimum investments, fees, project types, and investor eligibility.

The table below compares key features of these platforms:

Platform Minimum Investment Investor Type Project Focus Fees (%) Liquidity

Fundrise $500 Accredited & Non-Accredited Residential & Commercial 0.15-1.0 Quarterly redemption

RealtyMogul $1,000 – $25,000 Mostly Accredited Multifamily, Commercial 1.0 – 2.5 Limited secondary market

CrowdStreet $25,000 Accredited Commercial 0.5 – 2.0 Typically hold till project end

DiversyFund $500 Accredited & Non-Accredited Residential Focus 1.0 – 1.5 Quarterly liquidity windows

Investors must also assess the platform’s track record and the quality of due diligence conducted on listed projects. Platforms providing detailed investment summaries, historical performance data, and third-party appraisals typically enable better-informed decisions.

Evaluating Real Estate Projects for Investment

Not all real estate crowdfunding projects deliver equal returns or risk profiles. Thoroughly assessing each opportunity by examining property type, location, developer reputation, projected timelines, and exit strategies forms the basis of prudent investment.

For example, selecting a multifamily residential development in a rapidly growing urban market may offer dependable rental income and appreciation potential. Conversely, investing in a speculative commercial office complex during economic downturns could elevate risk substantially.

Consider the case of RealtyShares, a platform active until 2018, which facilitated investments in a multifamily complex in Atlanta. Investors saw robust returns due to the city’s booming rental demand and strong job growth. In contrast, projects concentrated in underperforming regions or with inexperienced developers have shown delayed completions and diminished payouts in several reported cases.

Key project evaluation criteria include: Market Analysis: Demographics, employment rates, and economic projections. Developer Track Record: Past project success, financial stability. Financial Projections: Expected cash flows, capitalization rates, and exit valuations. Legal Structure: Understanding investor rights, distributions, and protections.

Engaging with platforms that provide comprehensive data and third-party validation helps mitigate investment risks.

Managing Risks in Real Estate Crowdfunding

While real estate crowdfunding opens doors for many investors, it’s not without risks. Market volatility, project delays, developer defaults, and lack of liquidity can impact investment returns. Understanding and managing these risks is crucial.

First, investment diversification across multiple projects and property types can reduce the impact of any single project failing. For example, the Fundrise Starter Portfolio invests in a mix of commercial and residential assets nationwide, balancing income-generating properties with development opportunities.

Secondly, realistic expectations about liquidity are important. Most crowdfunding investments are illiquid, with holding periods typically ranging from three to ten years. Some platforms offer quarterly redemption windows or secondary markets, but these may feature restrictions or discounts.

Risk management also involves careful review of contractual terms related to distributions, capital calls, and governance. Provisions for what happens during project underperformance or market downturns should be clearly understood.

According to a PwC 2022 real estate report, projects with strong governance structures and transparent reporting experience 30% fewer investor disputes. Thus, choosing platforms and projects with high governance standards safeguards investments.

Practical Steps to Start Your Real Estate Crowdfunding Journey

Launching a real estate crowdfunding portfolio involves practical steps aimed at setting clear investment goals and conducting disciplined research.

- Define Investment Goals: Determine whether you seek income generation, capital appreciation, low risk, or higher yield speculative opportunities. Your financial objectives will dictate the type of projects and platforms that suit your portfolio.

- Verify Eligibility: Confirm whether you meet the platform’s investor criteria, including accreditation status, minimum investment size, and suitability.

- Register and Complete Due Diligence: Create accounts on chosen platforms, review available projects carefully, download offering memoranda, and utilize platform tools like investment calculators.

- Start Small and Diversify: Begin with modest investments on multiple projects to spread risk, then progressively increase your exposure as confidence and experience grow.

- Monitor and Manage: Track portfolio performance through platform dashboards, analyze returns against benchmarks, and stay updated on project developments.

As an example, Jane, a 35-year-old professional, began investing $1,000 in three different Fundrise offerings across residential and commercial sectors. Within two years, her portfolio yielded an average annualized return of 9.4%, illustrating how a disciplined approach and platform diversity foster growth.

Emerging Trends and Future Perspectives in Real Estate Crowdfunding

The future of real estate crowdfunding looks promising, driven by technological innovation and evolving regulatory frameworks. Advances in blockchain technology are set to revolutionize asset tokenization, enabling fractional ownership to become more liquid and tradable.

Platforms like RealT are pioneering blockchain-based crowdfunding that allows investors to purchase property shares as digital tokens, providing real-time trading opportunities on secondary markets. This could drastically reduce traditional illiquidity issues.

Additionally, regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) are progressively clarifying compliance guidelines for crowdfunding. The expansion of Regulation A+ offerings and simplification of investor accreditation promises to broaden participation further.

Data analytics and artificial intelligence tools are enhancing project evaluation processes, offering better risk assessments and predictive models guiding investment selection.

Sustainability, known as ESG (Environmental, Social, and Governance) investing, is also influencing project development strategies. Crowdfunding platforms increasingly emphasize green building practices and social impact projects, appealing to socially conscious investors.

According to Deloitte’s 2023 real estate outlook, these trends collectively predicted that real estate crowdfunding will represent more than 15% of overall private real estate investment flows by 2030, signaling significant market maturation.

Real estate crowdfunding offers a compelling avenue for investors seeking to diversify portfolios with relatively modest capital. By understanding the investment frameworks, selecting reputable platforms, thoroughly evaluating projects, and managing risks, new investors can participate confidently in this evolving market. As technology advances and regulations evolve, opportunities in real estate crowdfunding will become even more accessible, transparent, and potentially profitable in the years ahead.