Index Funds vs. ETFs: What’s Better for Beginners?

Investing for the future often starts with simple, low-cost, and diversified options. For many beginners, mutual funds and exchange-traded funds (ETFs) are the first stepping stones due to their ease of use and relatively lower risks compared to picking individual stocks. Among these, index funds and ETFs stand out as popular investment vehicles designed to replicate the performance of a market index. However, understanding their nuances is crucial for beginners aiming to optimize returns, minimize costs, and tailor their investment strategy.

In this article, we will explore the differences and similarities between index funds and ETFs, addressing factors such as cost, liquidity, tax efficiency, and accessibility. Real-world examples and comparative data will help demystify these choices so that beginners can make informed decisions aligned with their goals.

Understanding the Basics: What Are Index Funds and ETFs?

Index funds and ETFs both aim to track the performance of a specific market index, such as the S&P 500 or the Nasdaq-100. The goal is straightforward: provide investors with a diversified portfolio that mirrors the broader market performance without attempting to beat it.

Index funds are a type of mutual fund that pool money from investors to buy shares in the underlying stocks of the index. They are managed passively, meaning the fund manager does not pick individual stocks but follows a set benchmark. The key appeal is their simplicity and relatively low fees compared to actively managed funds.

ETFs, on the other hand, are traded like stocks on an exchange throughout the trading day. Similar to index funds, many ETFs are passively managed and strive to replicate index performance. However, ETFs allow real-time buying and selling, giving investors more flexibility with pricing and timing.

For instance, the Vanguard 500 Index Fund (VFIAX) is a renowned index fund tracking the S&P 500, while the SPDR S&P 500 ETF Trust (SPY) is a leading ETF with the same mandate. Both aim to mirror large-cap U.S. stock performance, but their structures differ significantly.

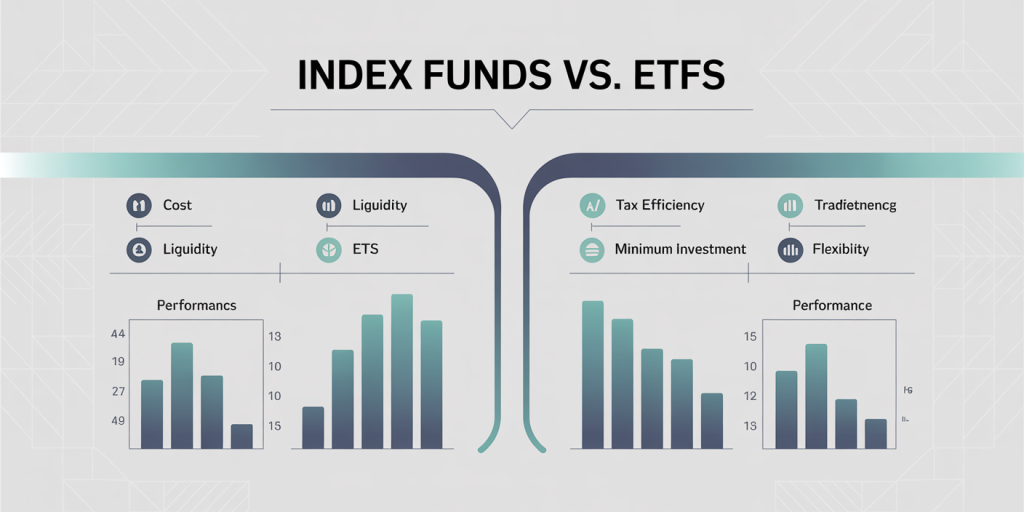

Cost Comparison and Fee Structures

One of the most important considerations for beginners is costs. Over time, fees can severely eat into investment returns, so choosing a cost-effective option makes a difference.

Expense Ratios

Index funds generally have low expense ratios compared to actively managed mutual funds, often in the 0.03% to 0.20% range. ETFs typically match index funds in expense ratios; some ETFs are even cheaper given the rigid competition in the ETF market.

For example, Vanguard’s S&P 500 index fund (VFIAX) has an expense ratio of 0.04%, whereas the SPDR S&P 500 ETF (SPY) charges about 0.09%. At face value, the index fund might appear cheaper, but other costs must be considered.

Trading Costs and Minimum Investments

While index funds usually do not charge a commission for buying or selling within the same fund family, they tend to have minimum investment requirements ranging from $1,000 to $3,000. ETFs can be bought one share at a time, making them more accessible with smaller capital.

However, purchasing ETFs involves paying broker commissions and bid-ask spreads. Although many brokers now offer commission-free ETF trades, spreads still exist and can slightly increase costs, particularly for less-liquid or niche ETFs.

| Feature | Index Funds | ETFs |

|---|---|---|

| Expense Ratio | Generally low (0.03%-0.20%) | Similar to index funds (can be lower) |

| Minimum Investment | Usually $1,000+ | One share (often <$100) |

| Trading Fees | Typically none | Potential commissions and spreads |

| Trading Flexibility | Once per day at NAV price | Throughout trading day at market price |

Practical examples demonstrate the impact: An investor with $500 can immediately start with ETFs but might have to wait or save more to invest in an index fund. Meanwhile, the difference in annual fees over decades, even for a 0.05% change, can amount to thousands in savings, emphasizing the importance of fees in long-term investing.

Liquidity and Trading Flexibility

Liquidity refers to how easily an asset can be bought or sold without affecting its price significantly. ETFs shine in this area because they trade like stocks on exchanges, offering immediate execution and transparency in pricing.

A beginner investor wanting to buy or sell shares during market hours can do so instantly with ETFs at the current market price. This intraday trading capability also enables strategies like stop-loss orders or limit orders — tools unavailable with index funds.

Index funds are priced once per day after the market closes, and transactions occur then. This mechanism means you won’t know the exact price at which you buy or sell until after the market close, which can be crucial in volatile markets.

However, the liquidity of ETFs depends on their trading volume and underlying assets. Highly liquid ETFs like SPY or Vanguard’s Total Stock Market ETF (VTI) offer large trading volumes and narrow bid-ask spreads, making trading efficient and inexpensive. Conversely, niche or newly launched ETFs may suffer from lower liquidity, increasing costs for the investor.

For beginners who prefer a “buy and hold” strategy without frequently reacting to market swings, the liquidity advantage of ETFs may be less significant. However, for those who want flexibility or the option to execute trades during the day, ETFs offer a clear edge.

Tax Efficiency: Which Option Holds the Advantage?

Taxes can significantly impact net returns, especially in taxable brokerage accounts. Both index funds and ETFs offer better tax treatment than actively managed funds due to minimal portfolio turnover, but ETFs generally provide slightly superior tax efficiency.

This difference primarily arises from the unique creation/redemption mechanism inherent to ETFs. When investors redeem ETF shares, authorized participants exchange ETF shares for underlying securities instead of selling securities on the market, thus reducing the chances of capital gains distributions.

In contrast, mutual funds, including index funds, must sell securities to meet shareholder redemptions. These trades can trigger capital gains, which are passed on to all shareholders. Consequently, investors in index funds might face unexpected tax bills at year-end even if they did not sell any shares themselves.

A study by Morningstar in 2020 showed that ETFs on average provided a 0.3%-0.4% higher annual after-tax return over comparable index funds. While seemingly small, this tax benefit compounds over time.

For example, an investor holding a taxable account with $10,000 invested for 20 years could end up thousands of dollars ahead by choosing ETFs due to tax savings, assuming average market returns and holding periods.

Accessibility and User Experience

When starting an investment journey, user-friendliness and ease of access are paramount. Both index funds and ETFs can be purchased through brokerage accounts, but differences exist related to platforms, investment minimums, and dividend reinvestments.

Index funds often require investments through mutual fund companies or retirement accounts with specific minimum amounts, which could deter investors with limited upfront capital. ETFs are accessible via any brokerage platform that offers stock trading, many of which allow fractional shares today, making it easier for small investors to diversify right away.

Fully automated robo-advisors, such as Betterment and Wealthfront, largely use ETFs in their portfolios because of their low costs, tax efficiency, and flexibility. These platforms also enable automatic dividend reinvestment and rebalancing, smoothing the path for beginners.

Practically speaking, a novice investor opening an account at a discount broker like Fidelity or Charles Schwab can easily buy shares of ETFs with no trading fees. Conversely, investing in index funds at the same brokerage might require meeting minimum investments and manually handling dividend reinvestments unless the fund offers these features.

Thus, ETFs are often seen as more adaptable and accessible, especially for investors starting with small amounts.

Future Perspectives: Trends Shaping Index Funds and ETFs

Over the past two decades, index funds and ETFs have revolutionized investing. Their growth is evident: In 2023, ETFs held around $7 trillion in assets globally, while index mutual funds accounted for roughly $10 trillion, indicating strong investor preference toward passive management.

Several trends are expected to influence these investment options going forward:

1. Increasing Popularity of Thematic and ESG ETFs: ETFs specializing in environmental, social, and governance (ESG) criteria or themes like technology and clean energy continue gaining momentum. These products provide exposure beyond traditional indices while maintaining ETF benefits.

2. Fractional Share Trading Expansion: Fractional shares now extend beyond ETFs into mutual funds, potentially blurring minimum investment differences. This could make index funds more accessible to new investors.

3. Lower Costs Across the Board: As competition intensifies, more fund providers reduce expense ratios, squeezing profit margins but benefiting investors. For example, Fidelity launched a zero-fee index mutual fund in 2023, challenging ETFs to lower prices further.

4. Technological Integration and Automation: Integration of ETFs and index funds into robo-advisors, retirement platforms, and personal finance apps makes investing more intuitive, personalized, and automatic.

5. Regulatory Changes: Future regulations aimed at transparency and investor protection may affect fund structures, disclosures, and tax treatments, shaping investor preferences.

In conclusion, both index funds and ETFs will remain foundational pillars for beginner and seasoned investors alike, evolving with technology, cost structures, and investor needs.

For beginners deciding between index funds and ETFs, understanding the trade-offs in cost, liquidity, tax efficiency, and accessibility is critical. ETFs typically offer greater flexibility and marginal tax advantages, while index funds emphasize simplicity and ease within traditional mutual fund structures. By aligning investment choices with individual financial goals, investment horizon, and trading preferences, new investors can establish a strong foundation for wealth-building.