How to Start Investing with Less Than 100 Reais

In today’s fast-paced economic environment, investing is no longer an exclusive activity for the wealthy. Thanks to digital platforms and financial innovations, individuals can begin building wealth with minimal capital. For Brazilians, the question often arises: “How do I start investing with less than 100 reais?” This article explores practical strategies and opportunities to make the most out of a small initial investment, ensuring steady financial growth and long-term benefits.

Brazil’s investment landscape has evolved considerably in recent years. The rise of fintech companies, commission-free investing apps, and government-backed savings programs provides more accessible options than ever before. According to the Brazilian Federation of Banks (Febraban), retail investment accounts increased by 25% in 2023, reflecting growing interest among small investors. Starting with under 100 reais might seem limiting, but with the right approach, it is possible to build a diversified portfolio and create a pathway toward financial stability.

Understanding the Basics: Why Start Investing with Little Money?

Starting to invest with less than 100 reais might seem intimidating due to perceived low returns or higher relative fees. However, the key benefit lies in building a habit and gaining investment experience without risking a large amount of capital. Behavioral finance specialists emphasize that early investment engagement can improve financial decision-making over time and help develop patience for long-term wealth accumulation.

Additionally, small initial investments can leverage compounding interest, a fundamental principle of investing. For example, a monthly contribution of 100 reais, with an average annual return of 8%, can grow to approximately 15,000 reais after 10 years. This illustrates how consistent, small investments enable one to benefit from exponential growth effects. Thus, starting small is less about immediate wealth and more about creating a consistent investment mindset.

Investment Options Available for Less Than 100 Reais

Savings Account vs. Tesouro Direto

Traditionally, many Brazilians park their savings in savings accounts (“poupança”), which offer liquidity and safety but very low returns (currently around 0.1% to 0.3% per month, or roughly 1.2% to 3.6% annually). While the safety is attractive, inflation often erodes the purchasing power of funds in this type of account.

A more promising alternative is Tesouro Direto, Brazil’s government bond program. With as little as 30 reais, it is possible to purchase government bonds that yield higher returns than savings accounts. For example, Tesouro Selic offers approximately 13.5% annual return (as of mid-2024), adjusted to the Selic rate, thus beating inflation and providing relative safety.

| Investment Type | Minimum Investment | Approximate Annual Return | Liquidity | Risk Level |

|---|---|---|---|---|

| Savings Account | 1 real | 1.5% – 3.5% | High | Very Low |

| Tesouro Direto | 30 reais | 8% – 13.5% | Medium (1 day to 1 month) | Low |

| CDB (Certificado de Depósito Bancário) | 100 reais | 10% – 13% | Medium (varies) | Low to Medium |

| Investment Funds | 50 reais | Varies (5% – 15%) | Varies | Varied |

Stocks and ETFs: Fractional Investments for Beginners

Buying individual stocks might sound expensive, but fractional shares are now available on platforms like XP Investimentos, Easynvest, and ModalMais, allowing investors to purchase a fraction of a share for under 100 reais. This democratizes access to the stock market and allows small investors to benefit from the appreciation of companies.

Additionally, investing in ETFs (Exchange Traded Funds) is a practical choice. ETFs pool resources from multiple investors to buy a diversified portfolio of assets. For example, funds like BOVA11 replicate the Bovespa Index and can be purchased with relatively little money.

Fractional stocks and ETFs reduce risk by spreading capital over multiple companies, unlike purchasing a single stock, which carries higher company-specific risk. This strategy aligns with Modern Portfolio Theory, advocating diversification to optimize returns relative to risk.

Practical Steps to Start Investing with Limited Capital

Step 1: Open an Investment Account

The first step is selecting a reliable brokerage. Many platforms offer zero account opening fees and no minimum deposits, such as Easynvest, Clear, and Rico. Users must have an active CPF (Cadastro de Pessoas Físicas) and an electronic ID for registration.

For example, João from São Paulo started investing with 50 reais on Easynvest in 2023 and bought his first Tesouro Direto bond. Within a month, he saw a modest but positive return that encouraged him to continue contributing small amounts every payday.

Step 2: Prioritize Low-fee Investments

With low capital, fees significantly impact net returns. Look for investments with minimal or no administration fees. Tesouro Direto has a small annual fee of 0.25% charged by the broker, while many investment funds charge between 0.5% and 2% annually.

If João had opted for a mutual fund with 1.5% fees from his initial 50 reais, the fees would consume a substantial portion of his returns.

Step 3: Automate Contributions and Reinvest Dividends

Another practical tip is automating monthly investments, even if small. Automatic debit setups in brokerage accounts or direct debits associated with banks reduce the lure to spend money earmarked for investment.

Reinvesting dividends and bond interest enhances compounding. For instance, Maria invests 80 reais monthly in dividend-paying ETFs; by reinvesting dividends instead of withdrawing, she has grown her portfolio by 40% over three years, outperforming regular saving products.

Diversification Strategies for Small Investors

Diversification is critical for reducing risks, especially for small portfolios. While spreading 100 reais might seem difficult, a mix of government bonds, ETFs, and fractional stocks is achievable.

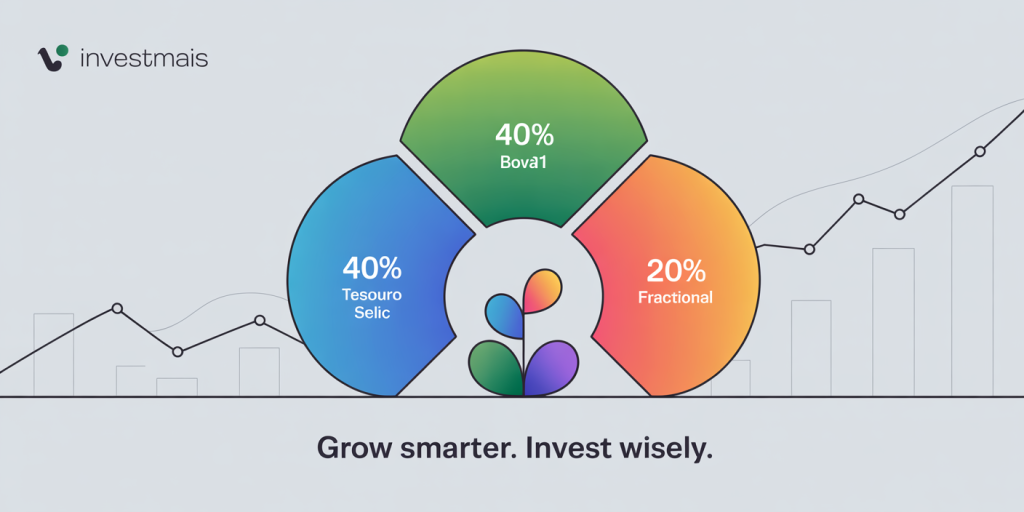

How to Allocate a 100 Reais Investment?

| Asset Type | Percentage Allocation | Amount in R$ | Reason |

|---|---|---|---|

| Tesouro Selic Bond | 40% | 40 reais | Stability and compound interest base |

| ETF (e.g., BOVA11) | 40% | 40 reais | Exposure to stock market and diversification |

| Fractional Stocks | 20% | 20 reais | Opportunity for growth in selected companies |

This structure leverages government bonds to maintain safety, ETFs for diversified growth, and fractional stocks for targeted upside potential. This method reduces exposure to any single asset and blends steady income with growth.

Real-Life Cases of Successful Micro-Investors

Consider Carlos, a young professional from Rio de Janeiro, who started investing 70 reais monthly in Tesouro Direto and fractional shares of selected blue-chip companies in January 2020. By 2024, his portfolio reached over 4,000 reais, built through consistent contributions, reinvestment of interest, and a long-term mindset.

Another case is Ana from Curitiba, who invested only 50 reais per month in ETFs focusing on Brazil’s renewable energy sector. Despite volatility, her portfolio grew 15% annually on average, and she reinvested dividends that accelerated asset growth.

Such cases illustrate that consistent contributions, patience, and proper asset choice often matter more than initial investment size.

The Future of Micro-Investing in Brazil

The investment ecosystem for small investors in Brazil is set for rapid growth. According to a 2024 report by the Brazilian Securities Commission (CVM), micro-investing platforms have seen user bases increase by 40% annually, driven by fintech innovation and increasing financial literacy programs.

Emerging trends include integration of artificial intelligence for personalized investment advice, cryptocurrency opportunities with regulated platforms, and more government incentives for small investors. The potential introduction of lower-taxation policies on long-term investments could further incentivize micro-investors.

Moreover, educational platforms and mobile apps are becoming crucial to democratize investment knowledge. As financial inclusion improves, it is conceivable that many Brazilians will upgrade from simply saving to actively growing their assets with small, recurring investments.

By keeping an eye on these trends and continuing disciplined investment practices, investors starting with less than 100 reais today can expect not only incremental financial gains but also enhanced confidence and access to more sophisticated markets in the future.

Starting to invest with less than 100 reais is not merely a financial act but the beginning of a transformative process toward wealth-building and economic empowerment. With the right knowledge, choice of assets, and commitment, it is possible for any individual to participate in Brazil’s growing investment market, capitalizing on opportunities and setting foundations for a stronger financial future.