How to Diversify Investments Even with Little Capital

In today’s dynamic financial landscape, diversification remains a critical strategy for minimizing risk and maximizing potential returns. However, the misconception persists that diversification is only accessible to wealthy investors with significant capital. Contrary to this belief, even individuals with modest savings can build a diversified investment portfolio. Leveraging strategic planning, accessible financial instruments, and knowledge of the market, small investors can reduce exposure to volatility and improve long-term financial outcomes.

According to a 2023 report by Vanguard, diversified portfolios tend to outperform highly concentrated investments over time, with a risk-adjusted return that is markedly superior. This article delves into practical methodologies, supported by real-world examples and data, illustrating how anyone can diversify investments effectively regardless of their starting capital.

Understanding the Importance of Diversification for Small Investors

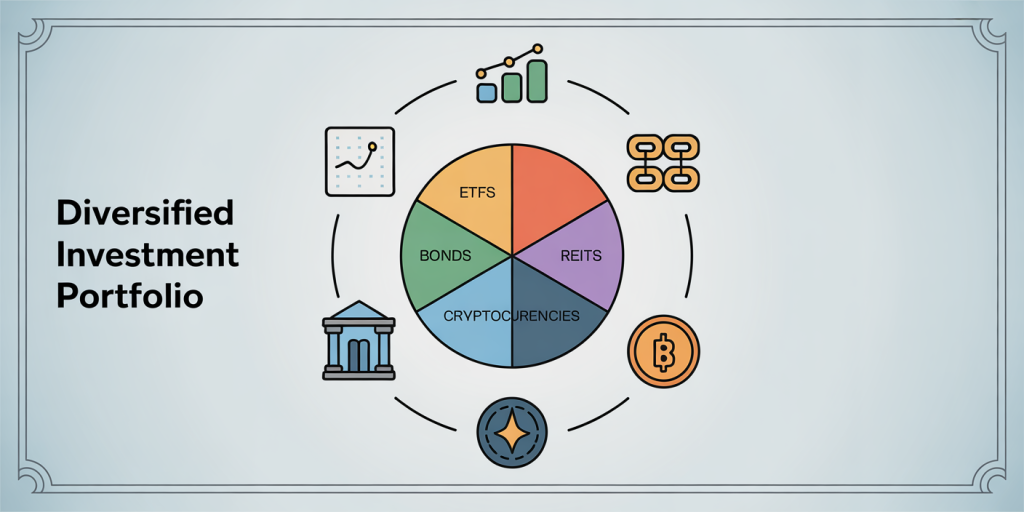

Diversification is the practice of spreading investments across various asset classes, sectors, or geographical regions to reduce risk. For small investors, diversification prevents dependence on a single investment’s performance and protects against severe losses. Studies show that portfolios diversified across asset classes like stocks, bonds, and real estate have historically provided smoother returns.

Consider the experience of Sarah, a young professional who started investing with just $500 per month. By allocating her funds monthly into a mix of exchange-traded funds (ETFs) that tracked different market segments, she reduced her exposure to individual stock risk. Over five years, Sarah achieved a compound annual growth rate (CAGR) of approximately 8%, outperforming peers who invested solely in a single equity.

Unfortunately, many small investors avoid diversification due to perceived minimums. Yet, with the advent of fractional shares, micro-investing platforms, and low-cost index funds, this barrier is rapidly diminishing. Tools like Robinhood, Acorns, and Betterment allow fractional ownership of high-value stocks and diversified ETFs with very low minimum investments, sometimes as low as $5.

Practical Ways to Diversify with Limited Capital

Utilizing Exchange-Traded Funds (ETFs) and Mutual Funds

ETFs and mutual funds aggregate investments into portfolios that span various asset classes and sectors. These vehicles allow small investors to obtain instant diversification without having to purchase multiple individual stocks or bonds. For example, an ETF like Vanguard Total Stock Market ETF (VTI) provides exposure to over 3,600 stocks from large to small-cap companies across the United States.

Aggressive investors can complement stock ETFs with bond ETFs such as iShares Core U.S. Aggregate Bond ETF (AGG), which covers a broad array of fixed-income investments. The combination helps balance growth potential against risk.

| Investment Type | Minimum Investment | Average Expense Ratio | Risk Level | Typical Return (Annualized) |

|---|---|---|---|---|

| Vanguard Total Stock Market ETF (VTI) | $10 (fractional) | 0.03% | Moderate to High | ~8-10% |

| iShares Core U.S. Aggregate Bond ETF (AGG) | $10 (fractional) | 0.04% | Low to Moderate | ~3-4% |

| Fidelity Zero Large Cap Index Fund (FNILX) | $0 | 0.00% | Moderate to High | ~7-9% |

*Table 1: Common low-cost ETFs and Index Funds suitable for small investors*

Platforms like Fidelity and Charles Schwab also offer no-minimum mutual funds, ideal for small investors seeking professional management. Importantly, the low expense ratios preserve more gains for the investor over time.

Exploring Fractional Shares and Micro Investment Apps

Fractional shares allow investors to purchase a portion of a stock, breaking down expensive equities into affordable units. This innovation democratizes access to companies like Amazon or Tesla, whose full shares may cost hundreds or thousands of dollars.

Take the example of John, who wanted to invest in Tesla but couldn’t afford a whole share priced at over $700. Using fractional shares through his brokerage’s app, he bought $50 worth of Tesla stock, becoming part-owner along with millions of others.

Micro-investment apps also facilitate dollar-cost averaging, investing small amounts regularly, which further decreases risk related to market timing. Acorns, for example, rounds up everyday purchases and invests the spare change into diversified portfolios starting at $5.

Considering Alternative Assets

Small investors can also diversify beyond traditional stocks and bonds. Real estate investment trusts (REITs) provide exposure to the real estate market without the capital-intensive commitment of property ownership. For instance, Realty Income Corporation (ticker: O) enables investors to receive monthly dividends from commercial real estate.

Crowdfunding platforms like Fundrise allow investments in real estate projects from as little as $500. This access broadens diversification by including asset classes that have historically performed differently than equities and bonds.

Cryptocurrencies, while volatile, represent another emerging avenue for small allocations. Many advisors recommend limiting crypto exposure to a small portion of the portfolio (e.g. 1-5%) to benefit from potential upside while managing risk.

Risk Management through Asset Allocation and Rebalancing

Diversification is not solely about owning many different assets; the allocation of those assets plays a crucial role in risk management. Understanding one’s risk tolerance, financial goals, and investment horizon informs the ideal mix between equities, fixed income, cash, and alternative investments.

For small investors, a commonly recommended allocation might be 60% equities, 30% bonds, and 10% alternatives or cash equivalents. However, younger investors with longer horizons may opt for more equities to seek higher growth.

Regular portfolio rebalancing is vital to maintain diversification. Over time, some assets may outperform, skewing the portfolio away from the targeted allocation. Rebalancing involves selling overweight assets and buying underweight categories to restore balance. This process also enforces a disciplined buy-low, sell-high strategy.

Consider a hypothetical portfolio initially allocated as:

| Asset Class | Allocation | Current Market Value | Target Allocation | Action Needed |

|---|---|---|---|---|

| Stocks | 60% | $6,500 | 60% | None |

| Bonds | 30% | $3,000 | 30% | None |

| Cash | 10% | $1,500 | 10% | None |

If stocks appreciate to become 70% of the portfolio value, rebalancing back to 60% would involve selling stocks and buying bonds or cash equivalents with the proceeds.

Leveraging Dollar-Cost Averaging to Enhance Diversification

Dollar-cost averaging (DCA) is the strategy of investing fixed sums at regular intervals regardless of market conditions. For investors with limited capital, DCA reduces the risk of investing a lump sum right before a downturn.

For example, Emma, who contributes $200 monthly to her investment account, buys shares of an ETF every month. When prices dip, her fixed $200 buys more shares; when prices rise, it buys fewer. Over time, this smooths the cost basis and reduces the impact of volatility.

Data from the U.S. Securities and Exchange Commission shows that, historically, DCA often results in better returns than trying to time the market, especially for small investors commencing their investment journey.

Future Perspectives: Technology and Accessibility Empower Small Investors

The future of investment diversification for small capital holders looks promising. Technological advances, growing financial literacy, and regulatory efforts to expand access have transformed the landscape.

Blockchain technology, for instance, is enabling tokenization of real-world assets, allowing tiny fractions of everything from art to commercial property to be bought and sold instantly on digital platforms. This evolution opens unprecedented diversification opportunities.

Furthermore, artificial intelligence-powered robo-advisors are making personalized portfolio management affordable. Companies like Wealthfront and Betterment provide automated rebalancing, tax-loss harvesting, and diversified portfolios tailored to individual goals for fees often below 0.5%.

Regulators are increasingly focusing on protecting small investors while enhancing market participation. The SEC’s encouragement of fractional shares and transparent fee structures supports broader engagement.

As capital markets continue to innovate, small investors can expect even more accessible, diversified investment options. By staying informed and utilizing available tools, they can build resilient portfolios that grow steadily over time despite limited initial capital.

—

By embracing a combination of ETFs, fractional shares, alternative investments, disciplined allocation, and technological platforms, small investors can effectively diversify their portfolios. With careful planning and regular contributions, diversification is achievable at any investment level, enabling sound wealth accumulation and risk reduction in an ever-changing financial world.