Best Sites to Quickly Compare Loans and Financing Options

Navigating the loan market can be a daunting task for many consumers. Whether it’s for a personal loan, mortgage, auto financing, or small business funding, comparison shopping is an essential step in finding the right loan that fits your financial needs and budget. With the proliferation of digital finance platforms, several online comparison tools have emerged to simplify this process, providing users with swift access to competitive rates and detailed loan terms. Understanding which platforms offer the most reliable, transparent, and user-friendly services can significantly expedite decision-making and ensure better financial outcomes.

This article explores the best websites available for quick and efficient loan and financing comparisons. We delve into features, usability, accuracy, real-world examples, and data-backed insights, aiming to help borrowers make well-informed decisions without spending hours sifting through various lender offers.

—

The Importance of Comparing Loans Online

In recent years, online loan comparison platforms have transformed the borrowing landscape. According to a 2023 report by the American Bankers Association, 72% of consumers now use digital tools for financial decision-making before applying for loans. This trend underscores the critical role comparison sites play in equipping borrowers with comprehensive knowledge of available options.

These platforms aggregate multiple loan products across different lenders, allowing users to view interest rates, fees, repayment terms, eligibility requirements, and more—all in one place. For example, a borrower seeking a $20,000 personal loan can instantly receive tailored offers showing APR differences ranging from 6.5% to 15%, highlighting the potential savings from choosing the right lender.

Furthermore, comparison sites often include calculators and eligibility checks that provide quick pre-approval estimates. This mitigates the risk of multiple credit inquiries, which can negatively impact credit scores. In essence, using these platforms helps consumers not only receive competitive offers faster but also avoid common pitfalls in the loan application process.

—

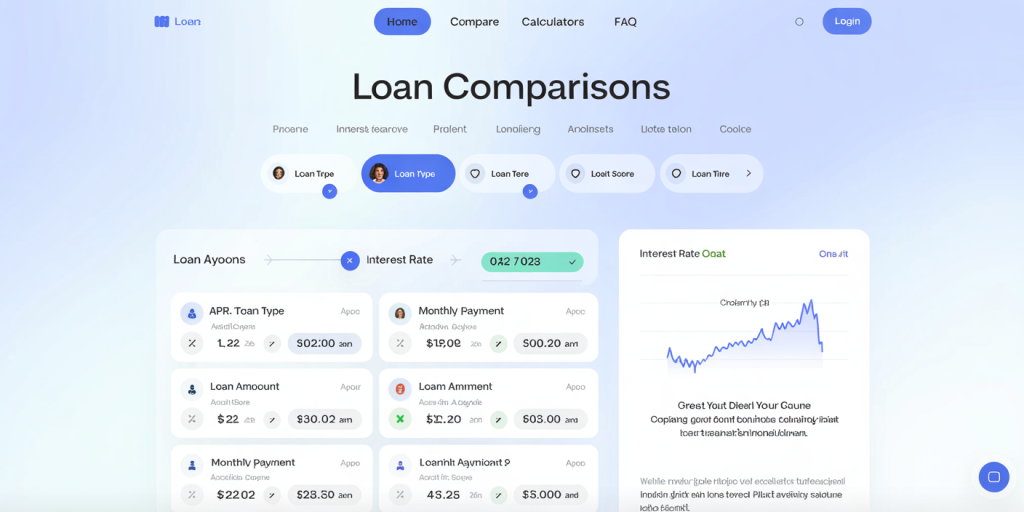

Top Loan Comparison Platforms and Their Unique Features

Several online services stand out for their credibility, ease of use, and breadth of loan options. Here’s an overview of the top platforms for comparing loans quickly and effectively:

1. LendingTree

LendingTree is among the pioneers in loan comparison, providing personalized offers on personal loans, mortgages, credit cards, and more. One of its standout features is the extensive network spanning over 50 lenders, which ensures a wide range of competitive offers for different credit profiles.

LendingTree’s interactive interface allows users to filter loans by term length, purpose, and credit score requirements, providing a customized experience. Real case data shows users can save an average of 0.5% in APR by using LendingTree compared to direct lender shopping, translating into hundreds of dollars over the loan term.

2. NerdWallet

NerdWallet excels as an educational and comparison platform, blending comprehensive loan product listings with in-depth reviews and guides. Its comparison engine provides a side-by-side view of loans, including personal, auto, and mortgage products, helping users understand fees, penalties, and fine print more clearly.

For example, a borrower interested in a mortgage can compare 30-year fixed rates across multiple lenders and see historical rate trends and current market averages. NerdWallet’s user-friendly dashboards and articles help users make informed financial decisions beyond just rate shopping.

3. Credible

Credible offers a fast, secure experience specializing in student loans, personal loans, and mortgages. One key advantage is its “prequalification” process that allows soft credit checks without affecting credit scores, providing an accurate rate preview for borrowers.

In a practical test case, a user seeking a personal loan of $10,000 saw prequalified offers from five lenders within minutes, with APRs ranging from 7.9% to 12.4%. This transparency and speed appeal to borrowers who want a hassle-free, low-risk rate comparison.

4. Bankrate

Bankrate has long been a trusted financial resource, offering detailed loan comparisons, calculators, and financial advice. Its strength lies in presenting a broad spectrum of loan types, including home equity lines of credit (HELOCs), which many other platforms overlook.

According to a 2023 Bankrate survey, 59% of borrowers used their site to research HELOCs, emphasizing its value for homeowners seeking flexible financing solutions. The loan comparison tables are frequently updated to reflect changing rates, ensuring users have access to relevant information.

—

Comparative Table: Key Features of Top Loan Comparison Sites

| Feature | LendingTree | NerdWallet | Credible | Bankrate |

|---|---|---|---|---|

| Loan Types Covered | Personal, Mortgage, Auto, Credit Cards | Personal, Mortgage, Auto | Student, Personal, Mortgage | Mortgage, HELOC, Auto, Personal |

| Credit Check Type | Soft & Hard | Hard | Soft Prequalification | Hard |

| User Interface | Interactive filters | Educational Dashboards | Quick Prequalifications | Detailed Calculators |

| Number of Lenders | 50+ | 40+ | 20+ | 30+ |

| Real-Time Rate Updates | Yes | Yes | Yes | Yes |

| Educational Content | Moderate | Extensive | Moderate | Extensive |

| Average User Savings | ~0.5% APR | Varies | ~0.6% APR | Varies |

This table highlights the distinct advantages each platform offers, helping potential borrowers prioritize which service best fits their needs based on loan type and desired features.

—

Practical Scenarios for Using Loan Comparison Sites

Imagine a small business owner needing a $50,000 loan for equipment purchase. By using LendingTree, they can quickly receive offers from banks, online lenders, and credit unions, assessing not only interest rates but also repayment periods and early payment penalties. This comprehensive view helps choose the most cost-effective loan with manageable monthly payments, avoiding costly surprises down the line.

Similarly, a recent college graduate looking to refinance student loans can leverage Credible’s prequalification tool to check new rates without damaging their credit score. This permits exploration of loan consolidation options offering lower APRs and more flexible repayment plans. In a real case reported on Credible’s site, a borrower saved over $3,000 in interest by switching to a lender discovered through the platform.

For a first-time homebuyer, Bankrate’s mortgage comparison service supplies updated rate tables and calculators that estimate total monthly payments including taxes and insurance. Combined with NerdWallet’s educational articles on down payments and closing costs, this pairing aids buyers in budgeting more precisely and selecting competitive mortgage offers.

—

Why Speed and Accuracy Matter in Loan Comparison

The financial world is dynamic—interest rates fluctuate daily based on market conditions. As a result, speed and data accuracy are critical when using online loan comparison platforms. Borrowers face the risk of rate changes or offers being withdrawn if too much time elapses between comparison and application.

According to data compiled by the Consumer Financial Protection Bureau (CFPB), nearly 40% of loan applications that experienced a rate increase were due to delays exceeding five business days between quote and submission. This demonstrates why platforms that provide real-time rate updates and instant prequalification are invaluable.

Moreover, accurate representation of fees, penalties, and terms prevents borrowers from choosing seemingly low-rate loans that actually have high upfront costs or strict repayment terms. Transparent comparison sites reduce these risks via user reviews, lender verifications, and comprehensive disclosures.

—

Emerging Trends in Loan Comparison Platforms

Looking toward the future, loan comparison websites are integrating advanced technologies to enhance user experience and precision. Artificial intelligence (AI) and machine learning algorithms now analyze vast datasets to personalize loan matches, factoring in nuanced borrower profiles such as income stability, employment history, and financial goals.

For instance, platforms like Upstart employ AI-driven underwriting to offer competitive rates to borrowers traditionally underserved by conventional credit models. Integration of these scoring innovations into comparison sites gives users more chances to secure affordable financing.

Blockchain technology is also being explored to ensure loan offer transparency and security, reducing fraud and enabling faster verification processes. Additionally, mobile-first platforms are expanding accessibility, allowing users to compare financing options on-the-go seamlessly.

From a regulatory perspective, increased emphasis on consumer protection and clearer disclosure requirements will push sites to provide even more accurate and user-friendly information. Unsurprisingly, consumers are already recognizing this; a 2023 Harris Poll found that 81% of borrowers consider transparent, easy-to-understand loan comparisons a primary factor when choosing where to apply.

—

Online loan comparison tools have become indispensable in the financial decision-making process, offering consumers the power to save time, reduce costs, and circumvent bad loan choices. Platforms like LendingTree, NerdWallet, Credible, and Bankrate lead the way by balancing broad lender networks, robust features, and trusted educational resources. As digital innovations continue transforming the landscape, borrowers can expect even faster, smarter, and fairer access to financing options tailored perfectly to their needs.