Apps for Freelancers to Manage Income and Expenses

In the dynamic world of freelancing, managing finances efficiently is a critical factor for success. Freelancers often grapple with irregular income, variable expenses, and tax obligations that demand systematic oversight. Fortunately, technological advancements have given rise to numerous applications tailored specifically to help freelance professionals track their income and expenses accurately. These apps are not only designed to simplify bookkeeping but also provide insightful data that aids in financial planning and business growth.

Freelancers handle multiple clients, varied payment schedules, and diverse expenditures ranging from software subscriptions to office supplies, making financial management complex and time-consuming. According to a 2023 survey by the Freelancers Union, over 60% of freelancers face difficulties in maintaining consistent cash flow records, underscoring the importance of effective digital tools. This article explores some of the best apps available, comparing their features and usability, and offering practical examples of how they can transform freelance financial management.

Why Freelancers Need Dedicated Financial Management Tools

In a traditional workspace, financial management is often streamlined through payroll systems and dedicated accounting departments. Freelancers, on the other hand, act as both the service provider and the financial manager. This dual role means that without the right tools, they may easily overlook critical financial details, such as late payments, deductible expenses, and tax liabilities.

For instance, a freelance graphic designer working with international clients must track payments in multiple currencies, manage invoice creation, and record business expenses like software licenses and digital asset purchases. An app that consolidates these functions allows freelancers to reduce human error and free up more time to focus on creative tasks. Moreover, proper financial documentation through specialized apps simplifies annual tax filings, which can be a daunting process for independent workers juggling various forms of income.

The increasing demand for transparency and financial control has pushed freelancers to adopt apps that not only log transactions but also provide comprehensive analytics, such as cash flow forecasting and profit-loss summaries. With apps optimizing these processes, freelancers can maintain healthier cash flow, improve budgeting, and gain better financial insights to scale their operations.

Top Apps for Income and Expense Management

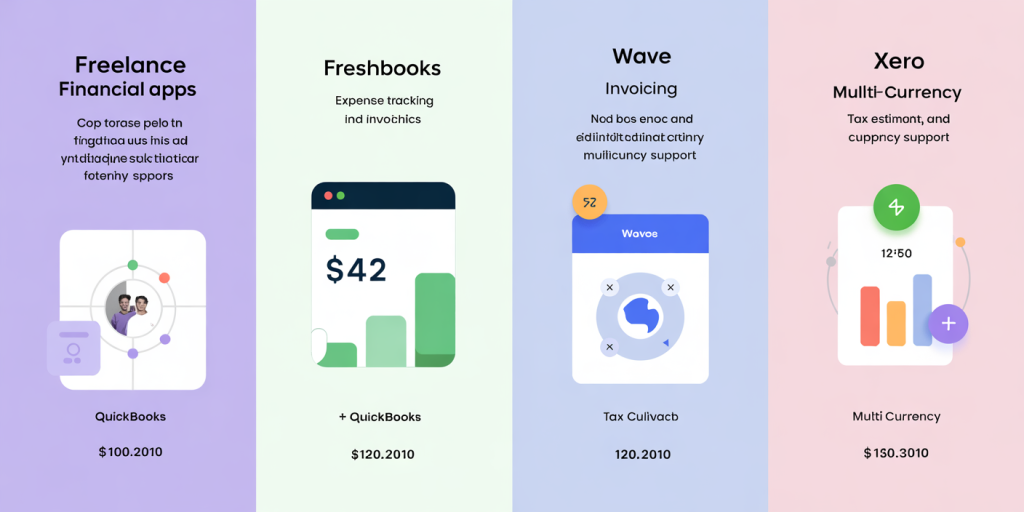

Several apps stand out for freelancers based on user-friendliness, feature sets, and adaptability to freelance needs. Below is a detailed look at five popular apps and their unique strengths, supported by comparative data.

1. QuickBooks Self-Employed

QuickBooks is widely regarded as a pioneer in financial software, and its Self-Employed version is crafted specifically for freelancers. The app automates expense tracking by syncing with bank accounts and credit cards, categorizes transactions for tax purposes, and generates quarterly tax estimates.

For example, a freelance content writer can connect her business checking account with QuickBooks, which will automatically classify payments from clients and monthly internet bills. The tax summary feature helps avoid surprises by providing advance quarterly tax deadlines, thanks to its IRS-compliant calculations. Additionally, QuickBooks Self-Employed supports invoicing and mileage tracking, making it an all-in-one financial tool.

2. FreshBooks

FreshBooks shines with its intuitive design and excellent invoicing capabilities. Ideal for freelancers who bill either hourly or per project, FreshBooks allows users to create professional invoices, automate payment reminders, and accept online payments.

Consider a freelance consultant managing multiple clients with varying rates. FreshBooks ensures timely invoicing and helps maintain updated payment statuses. The app also offers detailed expense tracking and integrates time tracking, which is beneficial for accurately billing clients. FreshBooks’ dashboard provides real-time insights into accounts receivable and payable, enhancing financial visibility.

3. Wave Accounting

Wave is a free accounting software that suits freelancers emerging in their careers or managing limited financial transactions. Despite being free, Wave offers comprehensive features including income and expense tracking, invoicing, receipt scanning, and report generation.

A newly started freelance photographer, for example, can use Wave for its receipt scanning via a mobile app to keep track of equipment purchases and other business expenses. Wave’s clean interface and absence of monthly fees make it accessible for freelancers seeking cost-effective solutions without compromising functionality.

4. Xero

Xero is another strong contender favored by freelancers who anticipate scaling their business. It integrates well with over 800 third-party apps, providing a customizable financial ecosystem. Xero automates bank reconciliations and includes comprehensive expense claims and invoice management.

Take the case of a freelance software developer using various platforms and tools requiring monthly fees. Xero simplifies the management of recurring expenses and seamlessly collaborates with tax advisors through secure, shared access. The app also supports multi-currency transactions, a plus for freelancers working with international clients.

Comparative Table: Key Features of Freelance Financial Apps

| Feature | QuickBooks Self-Employed | FreshBooks | Wave | Xero |

|---|---|---|---|---|

| Expense Tracking | Yes | Yes | Yes | Yes |

| Invoicing | Yes | Yes | Yes | Yes |

| Tax Estimation | Yes | Limited | No | Limited |

| Mileage Tracking | Yes | No | No | No |

| Multi-currency Support | Limited | Yes | No | Yes |

| Receipt Scanning | Yes | Yes | Yes | Yes |

| Price (Monthly) | Starting at $15 | Starting at $15 | Free | Starting at $12 |

| Suitable for Beginners | Moderate | Beginner-friendly | Beginner-friendly | Moderate |

Integration with Other Freelance Tools

A significant advantage of modern freelance income and expense management apps is their ability to integrate with other professional tools, optimizing workflows. Many freelancers rely on project management platforms, client communication tools, and CRM software, so seamless data flow between these systems improves productivity.

For instance, QuickBooks and Xero both offer integrations with popular platforms like Slack, Trello, and PayPal. This means invoices can be created automatically when a project milestone is reached or payments can be logged directly from PayPal transactions without manual input. FreshBooks also integrates with popular payment gateways like Stripe, accelerating invoicing and payment collection.

Moreover, time tracking apps such as Toggl or Harvest can sync with financial apps, translating billable hours directly into invoices. A freelance web developer, who logs dozens of small tasks daily against various projects, benefits notably from this integration as it removes the tedious manual step of calculating billable time.

By connecting these systems, freelancers ensure their financial data remains accurate and up to date, enhancing decision-making capabilities and reducing the risk of errors.

Practical User Experiences and Challenges

The transition to digital financial management apps can present challenges for some freelancers, particularly those less familiar with accounting principles. However, many users report that implementing these apps significantly reduces the administrative burden.

Take Michelle, a freelance copywriter from Austin, Texas, who struggled with late payments and chaotic expense records. After adopting FreshBooks, she attributes a 30% improvement in timely client payments to automated invoice reminders and a better understanding of cash flow via the app’s analytics. Similarly, Ahmed, a freelance translator based in Dubai, praises Wave’s free tools for helping him keep his small business compliant with local regulations without hefty accounting costs.

Despite these advantages, common issues include initial setup complexity and learning curves associated with app features. Freelancers must invest time upfront to categorize expenses correctly and customize invoices to suit client expectations. Additionally, apps sometimes have limitations handling complex tax scenarios unique to freelancers, requiring supplemental consultation with accountants.

Future Perspectives in Freelance Financial Management Apps

The landscape for freelance financial management software is continuously evolving, driven by advancements in artificial intelligence (AI) and machine learning. Future apps are expected to offer even more personalized financial advice and predictive analytics, enabling freelancers to anticipate cash flow issues and optimize tax strategies proactively.

AI-driven apps might soon analyze a freelancer’s spending patterns and suggest cost-saving measures or investment opportunities. Integration with digital wallets and cryptocurrencies may expand, reflecting emerging payment trends. Additionally, enhanced automation will reduce manual bookkeeping further, enabling real-time expense entry through smart receipt scanning and voice commands.

Data security and privacy are also gaining priority, especially as freelancers increasingly rely on cloud-based solutions. Future apps will likely incorporate stronger encryption and compliance measures with international data protection laws, providing peace of mind in managing delicate financial information.

Overall, the future promises more intuitive, adaptive, and integrated financial management tools, empowering freelancers to sustain and grow their businesses with greater confidence.

—

By choosing the right app tailored to their unique needs, freelancers can ensure efficient income and expense management, meet tax obligations seamlessly, and maintain a clear picture of their financial health. These technologies represent powerful allies in the pursuit of independent professional success.