How to Split Your Salary to Cover All Expenses Without Stress

Managing finances effectively is a skill that significantly impacts one’s quality of life. For many, the challenge lies not in how much money they earn but how to distribute their salary efficiently to meet all expenses seamlessly. Without a clear strategy, month-end can bring anxiety, debt, or missed financial goals. However, by learning to split your salary appropriately, you can maintain financial stability, reduce stress, and even pave the way for future wealth.

In this article, we explore proven methodologies and practical examples of splitting your salary to cover essential expenses, discretionary spending, savings, and debt repayments. This approach will help you gain control over your finances, avoid overspending, and ensure your money aligns with your priorities.

Understanding Your Financial Landscape

Before distributing your salary, it’s crucial to analyze your current financial situation precisely. Many individuals struggle because they do not track where their money goes each month. Start by listing all sources of income and fixed expenses such as rent, utilities, insurance premiums, and loan payments. Knowing your total monthly earnings after tax deductions and all mandatory contributions forms the foundation for a rational budgeting plan.

For example, consider Jane, a 29-year-old marketing professional earning a monthly net salary of $3,500. Her fixed expenses include $1,200 for rent, $200 for utilities, $300 for student loan repayment, and $150 for insurance. By totaling these essential costs ($1,850), Jane understands she has $1,650 remaining to allocate for food, transportation, entertainment, and savings.

It is equally important to differentiate between fixed and variable expenses. Fixed expenses remain constant each month (rent, loan payments), while variable expenses can fluctuate (groceries, dining out). Tracking these variations over three to six months offers a realistic picture of your spending habits. According to a survey by the U.S. Bureau of Labor Statistics in 2022, the average American household spends approximately 35% of their income on housing and utilities, highlighting the importance of evaluating personal allocations against such benchmarks.

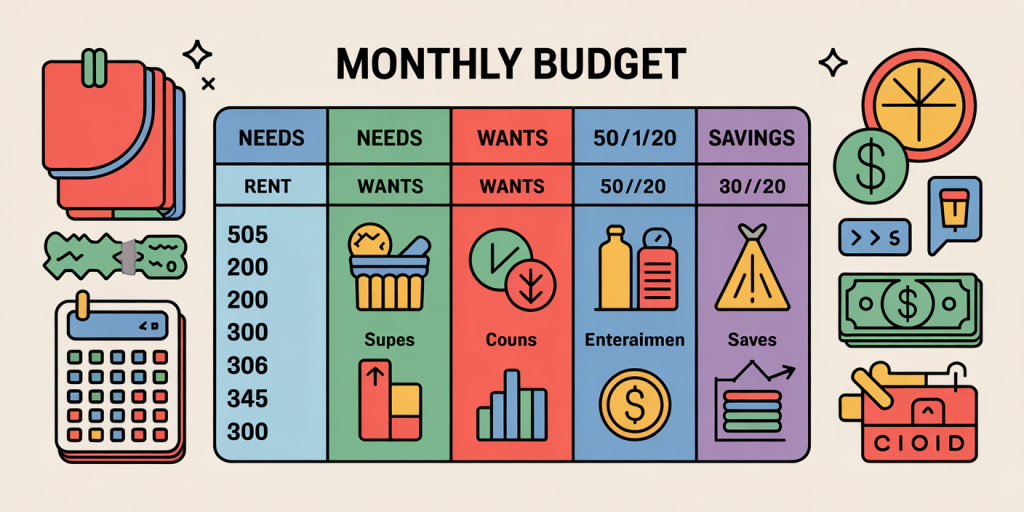

The 50/30/20 Rule: A Practical Framework

One of the most popular and straightforward methods to divide your salary for stress-free expense management is the 50/30/20 rule, popularized by Senator Elizabeth Warren. This rule advocates allocating 50% of your net income to needs, 30% to wants, and 20% to savings and debt repayment.

To clarify, “needs” include rent, groceries, healthcare, and transportation costs. “Wants” encompass dining out, hobbies, vacations, and entertainment. Finally, the “savings and debt” portion involves emergency fund contributions, retirement savings, and reducing outstanding debts.

Returning to Jane’s case, applying the 50/30/20 rule to her $3,500 salary would look like this:

| Category | Percentage | Amount |

|---|---|---|

| Needs | 50% | $1,750 |

| Wants | 30% | $1,050 |

| Savings & Debt | 20% | $700 |

Since Jane’s fixed costs ($1,850) slightly exceed the 50% threshold ($1,750), she needs to refine her budget. Options include reducing discretionary spending within the 30% “wants” category or finding ways to lower fixed expenses, such as negotiating rent or refinancing loans. The beauty of the 50/30/20 rule is its flexibility and simplicity, making it adaptable to various income levels and lifestyles.

Creating Separate Accounts for Expense Categories

Another effective strategy to split your salary is to open three or more dedicated bank accounts aligned with your budget categories. Allocating funds automatically to these accounts reduces the risk of overspending and makes it easier to track expenses.

For instance, Jane could set up the following accounts:

1. Essential Expenses Account: Covers rent, utilities, groceries, and transport. 2. Discretionary Spending Account: For dining out, hobbies, entertainment, and travel. 3. Savings & Debt Account: Dedicated to retirement fund, emergency savings, and loan repayments.

With direct deposit and automated transfers, Jane could split her monthly salary immediately as it arrives. If her salary is $3,500, Jane can program $1,750 to transfer automatically to the Essential Expenses Account, $1,050 to the Discretionary Spending Account, and $700 to the Savings & Debt Account.

Automation removes the temptation to dip into savings or unpaid debts and ensures each category gets appropriate funding. A 2021 study published in the Journal of Financial Planning found that individuals using separate accounts for specific budget categories reported 25% less stress related to financial management compared to those using a single checking account.

Incorporating Emergency Funds and Debt Prioritization

An overlooked but vital part of managing finances is setting aside money for unexpected expenses and aggressively repaying high-interest debt. Without an emergency fund, individuals often resort to credit cards or loans in crises, increasing financial stress.

Experts generally recommend building an emergency fund covering three to six months of living expenses. Using Jane’s essential expense total of $1,850 monthly, her emergency fund target should be between $5,550 and $11,100. Allocating even 10% of savings each month towards this fund can accelerate accumulation without disrupting daily finances.

Addressing debt repayment strategically also relieves stress. The avalanche method prioritizes paying off debts with the highest interest first, saving money over time. Alternatively, the snowball method focuses on clearing the smallest debts first, providing psychological motivation. According to a 2020 survey by the National Foundation for Credit Counseling, 63% of individuals who utilized a focused debt payment plan reported decreased anxiety about their finances within six months.

Integrating emergency saving and debt repayment into your salary split might require adjusting percentages temporarily but yields long-term peace of mind.

Tracking and Revising Your Budget Regularly

Splitting your salary isn’t a one-time set-and-forget event. Life circumstances like pay raises, moving to a new city, or changing family dynamics impact your budget needs. Regularly reviewing your financial plan ensures your salary distribution remains effective.

Using financial software or apps such as Mint or YNAB (You Need A Budget) allows you to monitor spending automatically and provides alerts when you near budget limits. If Jane notices her discretionary spending creeping above $1,050 consistently, she can analyze which areas to cut or if an increase in needs (e.g., utility bills) necessitates reallocation.

A comparative example of budget revision across three months might look like this:

| Month | Needs Spent | Wants Spent | Savings Allocated | Notes |

|---|---|---|---|---|

| Jan | $1,800 | $1,000 | $700 | Slightly over budget on needs |

| Feb | $1,700 | $1,100 | $700 | Overspend on wants; adjusted groceries |

| Mar | $1,750 | $950 | $800 | Increased savings for emergency fund |

By revising budgets and adjusting splits, you stay proactive rather than reactive, preventing financial stress before it escalates.

Future Perspectives: Evolving Your Salary Split System

As your financial situation improves or changes—whether through promotions, career changes, or fluctuating living costs—your salary split strategy should evolve accordingly. Automated budget allocations can be recalibrated to increase long-term savings or investment contributions. For example, once Jane’s emergency fund reaches her target, she might redirect those savings into a diversified portfolio to build wealth.

Additionally, incorporating tax-efficient savings vehicles such as 401(k)s or IRAs can optimize your after-tax income and boost retirement readiness. According to Fidelity Investments, individuals who consistently contribute at least 15% of their income toward retirement are more likely to achieve financial independence.

In the era of gig economies and fluctuating income streams, maintaining a flexible but disciplined salary split plan will remain invaluable. Combining automation, periodic reviews, and informed decision-making can transform personal finance from a source of stress into a foundation for security and aspiration.

—

Effectively splitting your salary to cover all expenses without stress involves clear understanding, practical frameworks such as the 50/30/20 rule, automated account segregation, proactive debt and emergency fund management, and dynamic budgeting. Through these methods, individuals can take control of their financial future, reduce anxiety, and ensure their income works for them today and tomorrow.