How to Curb Impulse Spending Without Losing Joy

Impulse spending can feel like a double-edged sword: the thrill of making spontaneous purchases brings immediate happiness, yet it can leave your budget strained and your financial goals compromised. According to a 2023 study by the National Endowment for Financial Education, approximately 84% of Americans admit to making some form of impulse purchase monthly, with over 13% spending more than $100 per impulse buy. While impulse spending is a natural human behavior driven by emotional triggers, eliminating it entirely isn’t necessary—or even desirable. The challenge lies in managing it smartly, so you maintain both your financial health and the joy that comes with rewarding yourself. This article delves into practical strategies that help curb impulsive spending without sacrificing the emotional satisfaction that occasional treats provide.

—

Understanding Impulse Spending: Emotional Triggers and Patterns

Impulse spending often stems from emotional responses rather than rational thinking. Online shopping algorithms and physical retailers capitalize on this by creating environments designed to evoke emotion-driven purchases. For instance, promotions like “limited-time offers” and “flash sales” tap into our fear of missing out (FOMO). A 2022 survey by Deloitte found that 62% of consumers made impulse purchases specifically in response to time-sensitive deals. Recognizing your spending triggers—whether stress, boredom, or social influence—is crucial.

Consider a common scenario: after a tough day at work, someone might buy an expensive gadget online to cheer themselves up. Although this purchase may provide short-lived joy, it can lead to buyer’s remorse later. By identifying such emotional triggers, you can develop healthier responses. For instance, replacing retail therapy with social interaction or exercise can lower the urge to splurge.

—

Setting Smart Budgets: Giving Structure Without Restriction

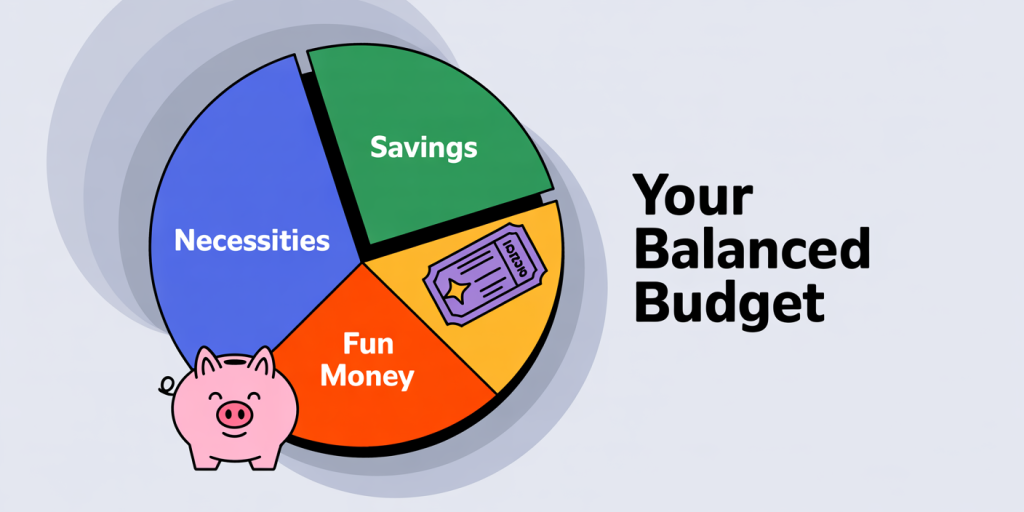

Building a budget that acknowledges variable spending habits can reduce impulsiveness and maintain joy in spending. The key is to allocate a discretionary spending fund—sometimes called a “fun money” budget—that allows for guilt-free spontaneous purchases within a set limit. According to a 2023 report from the Financial Consumer Agency of Canada, individuals who set aside a portion of their income for flexible spending are 35% more likely to report satisfaction with their financial management.

An effective approach to budgeting might look like this: allocate 50% of your income to necessities, 30% to savings and debt repayment, and 20% to lifestyle indulgences. Within that lifestyle 20%, stipulate an amount purely for spontaneous expenses. For example, if your monthly income is $3,000, $600 would be reserved for lifestyle expenses, and a portion of that (say $150–$200) could be impulse-friendly. This way, you enjoy occasional purchases without infringing on your financial stability.

Comparison Table: Traditional Budget vs. Flexible Budget Approach

| Budget Category | Traditional Budget (%) | Flexible Budget with ‘Fun Money’ (%) |

|---|---|---|

| Necessities | 60 | 50 |

| Savings/Debt Repayment | 30 | 30 |

| Discretionary Spending | 10 | 20 (includes ‘fun money’) |

This flexibility promotes discipline and joy simultaneously by acknowledging human tendencies rather than suppressing them outright.

—

Mindful Spending Techniques to Enhance Financial Awareness

Practicing mindfulness during purchases can curb impulsivity effectively. Mindfulness involves being fully present and aware of your actions, especially before hitting the “buy” button or swiping your card. One technique is the “24-hour rule”: commit to waiting 24 hours before making any non-essential purchase. This pause allows emotions to level out, reducing the chance of buyer’s remorse. According to a 2024 behavioral economics study published in the Journal of Consumer Psychology, consumers who adopted the 24-hour wait rule reduced impulse purchases by 40% in six months.

Another helpful technique is maintaining a spending journal. Writing down every purchase, including the motive behind it, sharpens awareness of spending triggers and habits. For example, you may discover that weekend afternoons prompt more spending due to boredom or social outings. With this knowledge, you can plan alternatives or budget more flexibly on weekends.

Apps such as “YNAB” (You Need A Budget) and “PocketGuard” incorporate mindful spending reminders. A 2023 survey by TechFinance found that 68% of users who used budget tracking apps reported spending less impulsively while still enjoying their desired purchases.

—

Embracing Alternative Joys: Rewarding Yourself Beyond Purchases

Reducing impulse spending does not mean abandoning joy; it means redefining sources of happiness. Research by the American Psychological Association shows that experiential purchases—such as attending concerts, outdoor activities, or dining with friends—yield longer-lasting happiness than material goods. Instead of buying another pair of shoes, you might invest in a painting class or a weekend hike with friends.

Additionally, cultivating hobbies or volunteering can fulfill emotional needs typically addressed via spending. For instance, joining a book club may replace the habit of spontaneous bookstore purchases with enriching social interactions.

Real-life case: Sarah, a 29-year-old marketing professional, struggled with impulse online shopping, spending over $300 monthly on non-essential items. After identifying boredom as her main trigger, she began attending local art workshops twice a month, spending less than $50 each time. Her happiness quotient increased while her impulse spending dropped by 60% within three months.

—

Navigating Sales and Marketing Traps Intelligently

Retailers use sophisticated marketing strategies to encourage humane impulsiveness. Flash sales, buy-one-get-one deals, and loyalty points all stimulate the desire to buy immediately. According to a 2023 study by the Consumer Federation of America, 71% of consumers reported increased impulse purchases after receiving marketing emails and push notifications.

To combat this, consider unsubscribing from promotional emails or activating filters to reduce digital marketing distractions. Setting calendar alerts can also help you plan purchases around genuine needs rather than sudden deals. For example, you might schedule buying essentials like clothing once every three months rather than succumbing to sporadic promotions.

Comparative Tactics to Resist Marketing Stimuli

| Tactic | Pros | Cons |

|---|---|---|

| Unsubscribing Emails | Reduces temptation reliably | May miss out on occasional genuine deals |

| Scheduled Shopping Alerts | Helps plan thoughtful purchases | Requires discipline to follow |

| Using Wishlist Functions | Delays purchases for reconsideration | May still allow spontaneous buying if unchecked |

Intelligent navigation of marketing traps helps maintain control without eliminating enjoyable deals or discounts.

—

Future Perspectives: Balancing Financial Wellness and Consumer Freedom

As technology advances, impulse spending faces both new challenges and opportunities. Artificial intelligence-driven personalized marketing is likely to grow more sophisticated, necessitating stronger consumer awareness and regulatory oversight. Future financial advisory tools may employ AI to reinforce personalized budgets and provide real-time notifications that flag impulsive tendencies.

Simultaneously, cultural shifts towards minimalism and sustainable spending suggest an evolving understanding of joy detached from material excess. Current trends, such as the rise of the “Experience Economy,” indicate that consumers increasingly prioritize meaningful experiences over possessions.

Emerging financial education programs are incorporating behavioral psychology to teach impulse control without deprivation. By adapting to these trends, individuals can look forward to a future where financial health and emotional satisfaction coexist harmoniously. Smart technology, combined with mindful practices, will empower consumers to enjoy their money responsibly.