How to Organize Your Monthly Bills Using the Envelope System

Managing monthly bills efficiently is a challenge for many households, especially in today’s dynamic financial environment. With rising inflation rates and increased household expenses, maintaining control over your finances is essential not only to avoid debt but to build savings and reduce stress. According to a 2023 survey by the National Endowment for Financial Education, about 59% of Americans struggle to pay bills on time, often due to disorganized financial management. One timeless and practical technique that can help is the envelope system—a physical, hands-on budgeting method that simplifies bill payment and expense tracking. This article explores how to organize your monthly bills using the envelope system, offers practical examples, and addresses the system’s long-term benefits.

Understanding the Envelope System for Monthly Bills

The envelope system is a budgeting strategy where you allocate a specific amount of money into separate envelopes designated for each expense category, including monthly bills. Originating from simple cash handling, this method encourages discipline and prevents overspending by limiting what you can use for each type of expense.

For monthly bills, the system involves labeling envelopes with bill names such as rent/mortgage, utilities, internet, insurance, and credit card payments. Before the month begins, you place the exact budgeted amount for each bill into the envelope. As you pay each bill, you use the money in the corresponding envelope, ensuring that funds are kept aside and accounted for.

For example, consider a household with rent of $1,000, utilities averaging $150, internet $60, and insurance $200 per month. The envelopes will hold these amounts respectively, so the payer knows exactly how much is available and devoted to bill payments without mixing funds for other expenses like groceries or entertainment.

Setting Up Your Envelope System: Step-by-Step Process

Establishing your envelope system requires a clear understanding of your monthly bills, budget, and available funds. Start by listing all your recurring monthly bills, verifying due dates and average amounts either from previous bank statements or direct bills. This checklist serves as the foundation for your envelopes.

Next, determine the budgeted amount to place inside each envelope. For fixed bills like rent and subscription services, this is straightforward. For variable bills such as electricity or water, estimate the highest expected value to avoid shortages. For instance, if your electricity bill varies between $100 and $150, budget $150 to cover peak months safely.

Once you have your list and amounts, procure physical envelopes or create labeled folders if you prefer digital tracking. Write the bill name and amount on each envelope clearly. On the first pay period or month start, withdraw cash or allocate funds from your bank account into each envelope accordingly.

To illustrate efficiency, a practical example from a working professional earning $3,000 monthly: Rent envelope: $1,000 Utilities envelope: $150 Internet envelope: $60 Insurance envelope: $200 Credit card payment envelope: $500 This template immediately reflects where money is frozen for necessary expenses, leaving the remainder for discretionary spending.

Benefits of Using the Envelope System for Bill Management

The envelope system offers several pragmatic benefits for handling monthly bills. First, it enforces budgeting discipline by restricting spending to predetermined amounts. This limitation helps avoid the common pitfall of paying bills late due to cash flow mismanagement or unexpected expenditures.

Second, the physical aspect of the envelope system creates a tangible awareness of money. Handling cash and “seeing” the money allocated to bills reinforces financial responsibility, making it easier to resist impulsive spending. Research in consumer psychology indicates that physical cash can reduce spending tendencies compared to digital transactions, thus improving adherence to budgets.

Additionally, the envelope system makes tracking bill payments simpler since each envelope corresponds to specific expenses. When an envelope is empty, you know that the bill has been paid or funds are used, reducing confusion about outstanding dues.

Here is a comparative table summarizing advantages of the envelope system versus typical digital-only budgeting:

| Feature | Envelope System | Digital Budgeting Apps |

|---|---|---|

| Physical money awareness | High | Low |

| Ease of tracking bill funds | Very clear and straightforward | Can be complex with multiple accounts |

| Risk of overspending | Reduced due to limited envelopes | Dependent on user discipline |

| Automation of payments | None, manual payments required | Often automated |

Choosing between digital and envelope systems depends on personal preferences and management style, but the envelope method remains an effective, no-frills solution for many households.

Integrating the Envelope System with Modern Bill Payment Methods

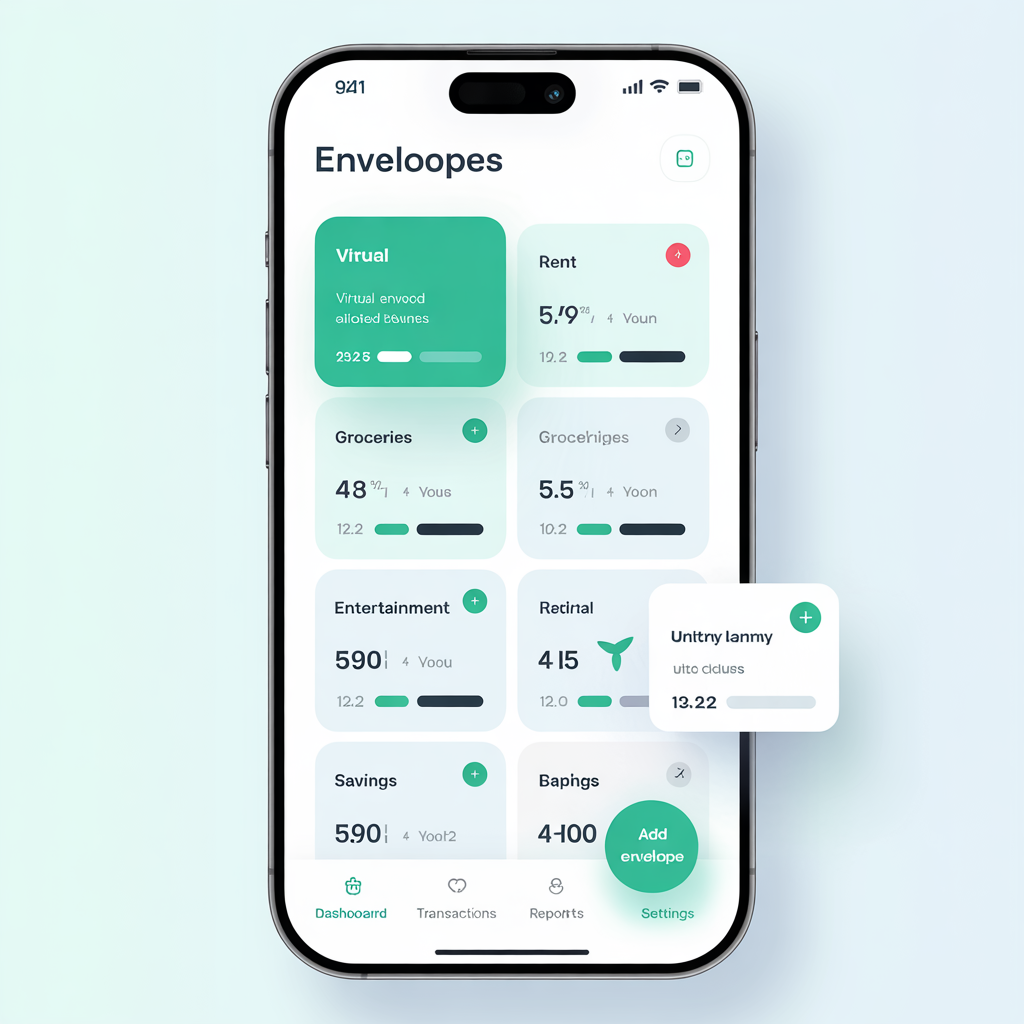

While traditionally cash-based, the envelope system can be adapted for digital payments—even in an increasingly cashless economy. This hybrid approach involves creating virtual “envelopes” within banking apps or budgeting tools that allow you to allocate funds accordingly.

For example, some banks offer sub-accounts or “pockets” where you can distribute money for bills, replicating the envelope system’s concept digitally. You put aside the exact bill amount in each pocket, and when bills are due, transfer funds or auto-pay using these reserves.

Case study: Jessica, a self-employed consultant, uses her bank’s budgeting features to create envelopes for each monthly bill. She budgets her funds every paycheck into these virtual envelopes, enabling accurate bill tracking without physical cash. This approach has helped Jessica reduce payment delays by 30%, according to her personal expense records after six months.

Moreover, integrating reminders with envelope budgeting—such as calendar alerts on bill due dates—creates synergy between organization and timely payments, preventing penalties and enhancing credit scores.

Real-Life Challenges and How to Overcome Them

Despite its benefits, the envelope system can face practical challenges. One common issue is handling fluctuating bills, particularly for utilities where usage varies. Over-allocating envelopes can limit funds for other needs, while under-allocating risks bill payment delays.

To address this, a buffer envelope is recommended. This is a separate envelope for miscellaneous or variable overages related to bills. If your utility bill is $150 but you budget $130, the difference can be covered by the buffer envelope. This pragmatic system reduces strain and maintains bill payment discipline.

Another challenge is maintaining consistency in contributions. Real cases show that people often neglect refilling envelopes after a payday or holiday spending. Setting automated calendar reminders or integrating envelope reviews into weekly routines can mitigate these lapses.

Additionally, for those uncomfortable dealing with cash, pairing the system with debit cards is viable. Assigning cards for certain envelopes with preset spending limits mimics the physical envelope constraints within a digital framework.

Statistically, households tracking expenses via envelope systems report up to 25% better bill payment timeliness, according to a 2022 Consumer Finance survey, validating its practical effectiveness.

Future Perspectives: The Envelope System in the Digital Age

As financial technology advances, the envelope system is evolving from purely physical cash management to sophisticated digital tools. Mobile apps such as Goodbudget and Mvelopes digitally emulate the envelope method by letting users allocate and track money per category. These apps sync with bank accounts and provide real-time balance updates, improving convenience.

Furthermore, artificial intelligence (AI) integration in budgeting tools predicts upcoming bills based on historical data, suggesting envelope allocations and warning of insufficient funds. This proactive approach can reduce payment misses and support personalized financial guidance.

Blockchain technology also offers possibilities for decentralized budgeting, where smart contracts automatically allocate money into virtual envelopes and trigger bill payments without manual intervention, enhancing security and transparency.

Despite technological shifts, the core principle of the envelope system—dividing money into distinct purposeful categories—remains relevant. Its easy-to-understand methodology is accessible for people of varied financial literacy levels, ensuring ongoing adoption amid digital transformation.

Still, the future likely involves hybrid methods leveraging the tactile discipline of the envelope system enhanced by automation and predictive analytics. This combination may usher in a new era of financial mindfulness and competence.

—

Organizing your monthly bills with the envelope system offers a simple yet powerful framework for achieving financial stability. Through disciplined budgeting, clear fund allocation, and adaptable integration with modern tools, this time-tested method mitigates stress and promotes timely bill payment. Whether you opt for physical envelopes or digital equivalents, the system’s transparency and control empower better financial decision-making. As technology continues to evolve, combining traditional hands-on budgeting with intelligent digital tools represents an exciting frontier for mastering your personal finances.