Budgeting for Beginners: How to Start Controlling Your Money

Managing personal finances effectively is a vital skill that can lead to financial security and peace of mind. For many, the concept of budgeting can feel overwhelming or restrictive, but it’s actually a powerful tool that helps individuals take control of their money, reduce stress, and achieve their financial goals. According to a recent survey by the National Endowment for Financial Education, nearly 60% of Americans feel stressed about money, and over half do not use any form of budgeting system. This reflects a significant opportunity for beginners to adopt budgeting strategies that empower them financially.

Starting with a budget is like creating a roadmap for your money. It allows you to see exactly where your income is going and make deliberate choices. This article will guide beginners through simple, actionable steps to start budgeting, provide practical examples, incorporate comparative tools, and share insights into future trends that can impact money management.

Why Budgeting is Essential for Financial Well-being

Understanding why budgeting matters is the first step toward financial empowerment. Budgeting helps you balance income with expenses, ensuring you live within your means while setting aside savings. Without a budget, it’s easy to fall into the trap of spending impulsively or not saving enough for emergencies or important goals. For example, a 2023 report from the Federal Reserve found that 40% of Americans would struggle to cover an unexpected $400 expense, highlighting the need for proper planning.

Budgeting also provides clarity and accountability. When expenses are tracked diligently, it becomes easier to spot wasteful habits or unnecessary subscriptions. For instance, many people underestimate how much they spend on daily coffee or dining out. By tracking these expenses, you can redirect that money toward debt repayment or savings. This mental shift from reactive to proactive financial behavior reduces anxiety and builds confidence over time.

Step-by-Step Guide to Building Your First Budget

Starting a budget can seem intimidating, but breaking it down into manageable steps simplifies the process. The first step involves recording all sources of income, including salary, freelance work, or passive income streams. Use net income (take-home pay after taxes) to get an accurate picture of available money. For example, if you earn $3,500 monthly after taxes, that figure becomes your starting point.

Next, list all monthly fixed expenses such as rent, utilities, loan payments, and insurance. Then, estimate variable expenses that fluctuate, like groceries, entertainment, and transportation. A practical approach is using banking apps or spreadsheets to categorize these expenses. Tools like Mint or YNAB (You Need A Budget) are highly recommended for beginners because they automatically import transactions and provide visual spending reports. Suppose your fixed expenses total $2,000 and variable expenses approximately $800; that leaves $700 potentially available for savings or discretionary use.

For beginners, the “50/30/20 rule” (50% needs, 30% wants, 20% savings/debt repayment) offers a simple blueprint. If total income is $3,500, allocate $1,750 for essentials, $1,050 for discretionary spending, and $700 toward savings or debt. Adjust these allocations as necessary based on personal circumstances and financial goals.

Practical Examples of Budgeting in Real Life

To better illustrate, consider Jane, a 28-year-old marketing professional earning $4,000 monthly after taxes. Jane’s fixed expenses are $1,800, including rent, utilities, and student loan payments. She models her budget after the 50/30/20 rule:

| Category | Monthly Budget | Actual Expenses | Notes |

|---|---|---|---|

| Needs (50%) | $2,000 | $1,800 | Under budget by $200 |

| Wants (30%) | $1,200 | $1,350 | Overspent dining out |

| Savings/Debt (20%) | $800 | $600 | Under savings goal |

In Jane’s case, overspending on wants indicates room for improvement by cooking at home or finding less expensive entertainment. By tracking these amounts monthly, she can adjust goals and prevent overspending. Another real case is Michael, a freelancer whose income fluctuates monthly. He creates a conservative budget based on his lowest expected income and saves the surplus during higher-income months, leveraging a buffer for months when work is scarce.

Tools and Techniques to Enhance Budgeting Efficiency

Harnessing technology can simplify budgeting tremendously. Personal finance apps like PocketGuard, EveryDollar, and Personal Capital offer customizable budgets, reminders, and syncing with bank accounts, reducing manual entry errors. Moreover, spreadsheets remain a valuable tool for those wishing to tailor budgets precisely.

Creating a separate emergency fund is another budgeting technique that protects against unforeseen expenses. Financial advisors often recommend saving three to six months’ worth of essential expenses. Automatic transfers set up from checking to savings accounts help build this fund effortlessly. For example, allocating a modest $100 monthly toward an emergency fund adds up to $1,200 yearly, which can provide significant peace of mind in case of job loss or medical emergencies.

Another method gaining popularity is the envelope system, which involves allocating a fixed amount of cash to various spending categories. When the cash runs out, spending in that category stops, helping control impulsive behavior. This tactile approach may suit those who prefer physical money handling over digital transactions.

Comparative Table: Common Budgeting Methods

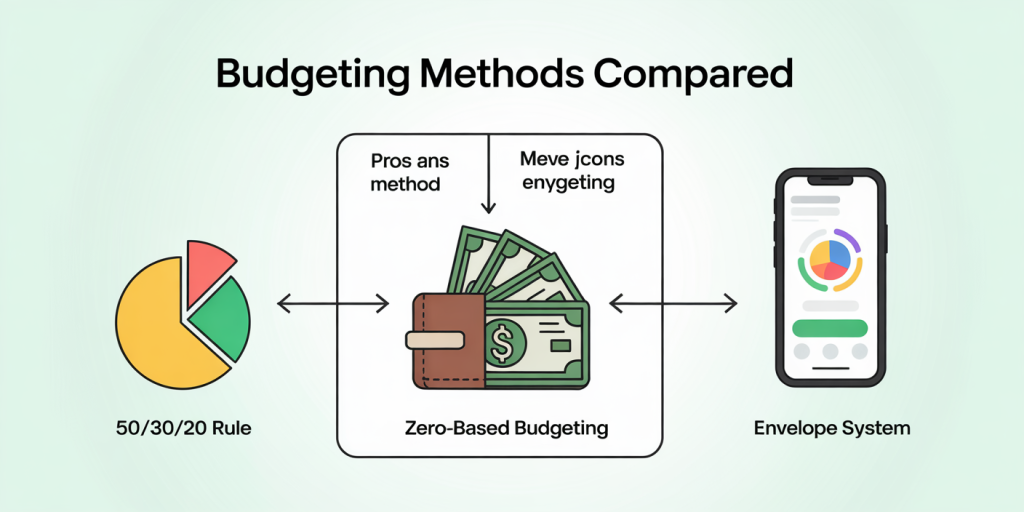

To help beginners choose a method aligned with their lifestyle, here’s a comparison of popular budgeting techniques:

| Budgeting Method | Description | Best For | Pros | Cons |

|---|---|---|---|---|

| 50/30/20 Rule | Divides income into needs, wants, savings | Beginners, those wanting simplicity | Easy to remember, balanced approach | May not fit high debt or irregular income situations |

| Zero-Based Budgeting | Every dollar is assigned a purpose | People wanting detailed control | Maximizes money usage, reduces waste | Time-consuming, requires regular updates |

| Envelope System | Physical cash allocated in envelopes | Cash users, impulse spenders | Controls overspending, tangible | Inconvenient with digital payments |

| Pay-Yourself-First | Savings allocated before expenses | Savers and investors | Prioritizes savings | Needs strict discipline, hard with irregular income |

| Incremental Budgeting | Builds on previous budgets | Those with stable incomes | Simple for minor adjustments | Not responsive to major life changes |

Overcoming Common Budgeting Challenges

New budgeters often face hurdles such as inconsistent income, difficulty tracking expenses, or feeling restricted by spending limits. Recognizing these challenges early helps develop sustainable habits. For freelancers and gig workers, fluctuating income means budgeting based on the lowest monthly earnings and saving surpluses, as demonstrated by Michael earlier. This approach prevents shortfalls during lean months.

Sticking to a budget also requires behavioral change. Many beginners underestimate discretionary spending or forget small purchases that add up. Keeping receipts or using mobile apps that track spending in real-time can mitigate this problem. Accountability partners or financial coaching sessions can provide motivation and expert guidance.

Budgeting doesn’t mean deprivation—it’s about making conscious decisions aligned with priorities. For instance, if travel is a passion, adjusting other categories to save more for vacations makes the budget feel less restrictive and more personalized. Celebrating small victories, like paying off a credit card or saving for a new gadget, reinforces positive habits.

Future Perspectives: The Evolution of Budgeting and Money Management

Personal budgeting is evolving rapidly due to technological advancements and changing economic conditions. Artificial intelligence (AI) and machine learning are being integrated into financial apps to provide personalized spending advice, detect unusual transaction patterns, and optimize savings goals dynamically. For example, Cleo, an AI-powered chatbot, offers budgeting tips tailored to user habits, making money management more interactive and adaptive.

Moreover, the rise of cryptocurrency and decentralized finance (DeFi) may influence traditional budgeting frameworks. As digital assets become part of more portfolios, budgeting tools will need to accommodate volatile asset classes and incorporate risk management strategies accordingly.

Economic shifts like inflation fluctuations, remote work prevalence, and changes in consumer behavior require budgets to be more flexible. Future budgeting techniques may include predictive analytics to anticipate income changes or expenses based on various scenarios, enhancing preparedness.

Education will also play a critical role. Increasing financial literacy efforts, especially targeting young adults, can foster early adoption of budgeting habits. Schools, employers, and online platforms are investing in resources that demystify money management, cultivating financially savvy generations.

In summary, budgeting is a timeless skill that adapts with technology and personal circumstances. For beginners, embracing simple steps today lays the foundation for a financially secure future, while leveraging new tools and data insights will enhance control and foresight in years to come. Empowering yourself with a budget is not merely about tracking expenses but creating a vision for your financial well-being and freedom.