Tips to Get Out of Debt and Regain Control

Debt is a reality many face at some point in their lives, whether due to unexpected expenses, lifestyle choices, or financial emergencies. According to Experian’s 2023 Consumer Debt Study, the average U.S. household carries over $90,000 in debt, including mortgages, credit cards, student loans, and other financial obligations. While debt itself is not inherently negative, unchecked debt can spiral out of control, resulting in financial stress, diminished credit scores, and reduced freedom. However, with the right strategies and mindset, regaining control over one’s finances and moving toward a debt-free life is achievable. This article explores practical, actionable tips for managing and eliminating debt, illustrated with real-life examples and supported by data-driven insights.

Understanding Your Debt Profile

The first step toward resolving debt is developing a clear understanding of your current financial situation. Many individuals accumulate debt without full awareness of the types of debt they have, interest rates, or repayment terms. Start by creating a comprehensive list of all debts, including outstanding balances, interest rates, minimum monthly payments, and due dates.

For example, Jane, a 35-year-old graphic designer, discovered she was juggling three credit card balances at 18% interest, a car loan at 6%, and student loans with rates ranging from 4% to 7%. By documenting all her debts, Jane could visually prioritize her repayment plan. According to the Federal Reserve, average credit card interest rates hover around 16%, making these debts the most financially damaging.

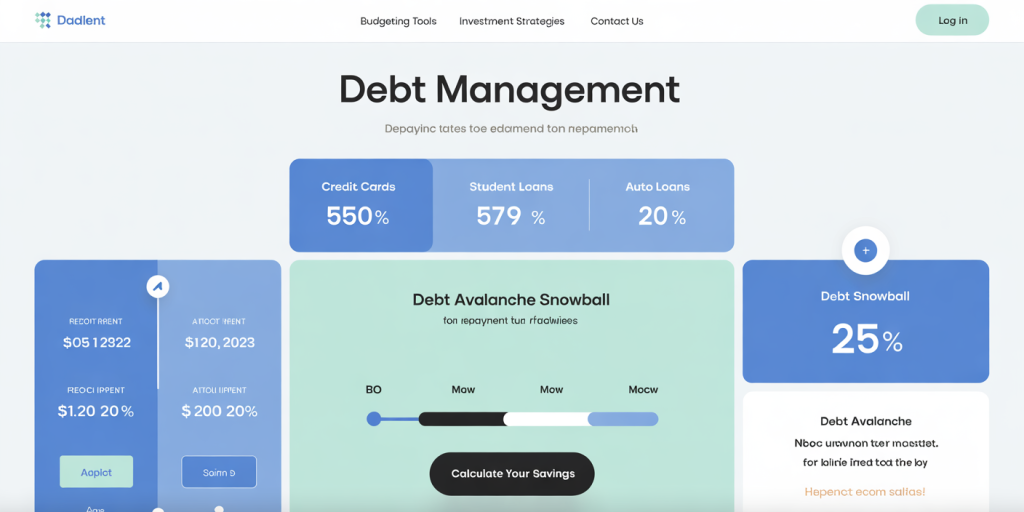

Sorting debts by interest rates often reveals where to focus repayment efforts to minimize total costs. Using the “debt avalanche” method—paying off the highest-interest debt first while making minimum payments on others—is a proven strategy to reduce the amount paid over time. Alternatively, the “debt snowball” method, which focuses on paying off the smallest balance first, can build motivation through quick wins.

Debt Profiles Comparison Table

| Debt Type | Average Interest Rate | Typical Term Length | Monthly Minimum Payment (Example) | Impact on Credit Utilization |

|---|---|---|---|---|

| Credit Card Debt | 16%-18% | N/A (revolving) | 2-4% of balance | High (directly affects score) |

| Personal Loans | 6%-12% | 2-5 years | Fixed payment | Moderate |

| Auto Loans | 4%-7% | 3-7 years | Fixed payment | Low |

| Student Loans | 4%-8% | 10-25 years | Fixed or income-driven payment | Low |

Creating a Realistic and Sustainable Budget

Once the full scope of debt is clear, crafting a budget aligned with income and expenses becomes crucial. Many debtors overlook this step, leading to recurring shortfalls and additional debt accumulation. A sustainable budget ensures that living costs, debt repayments, and savings coexist without stress.

Budgeting tools, such as Mint, YNAB (You Need A Budget), or simple spreadsheets, help track monthly income sources against expenses like rent, utilities, food, transportation, and debt payments. It’s essential to cut discretionary spending and redirect funds toward debt reduction. For example, Mark, a 42-year-old marketing manager, eliminated his daily $7 coffee purchase, saving over $200 monthly which he funneled into paying off credit card debt faster.

The 50/30/20 rule is a popular budgeting guideline wherein 50% of income covers needs, 30% wants, and 20% savings and debt repayments. However, heavy debt burdens may necessitate reallocating the 30% “wants” portion for accelerated debt clearance. The Consumer Financial Protection Bureau (CFPB) emphasizes that even small reductions in monthly spending can collectively create a significant impact on debt repayment timelines.

Leveraging Debt Repayment Strategies Effectively

Multiple methods exist to tackle debt, each with strengths depending on individual circumstances. Beyond the debt avalanche and snowball mentioned earlier, debt consolidation and refinancing are viable options for some.

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate, simplifying payments and potentially saving money on interest. For example, a borrower with multiple credit card debts might consolidate them into a personal loan at 8% interest instead of 18%. According to a 2023 LendingTree report, consumers who consolidated debt saved an average of 3-5 percentage points in interest rates, reducing total repayment costs by up to 20%.

Refinancing existing loans, especially mortgages or auto loans, may also lower monthly payments or interest rates, freeing up funds to pay other debts faster. However, these strategies require good credit standing and may involve fees or longer repayment periods, so they require careful consideration.

Alternatively, negotiating directly with creditors can yield benefits such as lower interest rates, waived fees, or extended payment plans. Real-life stories, like that of Sarah, who called her credit card issuers and obtained a temporary interest reduction, show how proactive communication can lead to tangible savings.

Building Emergency Savings to Prevent Debt Recurrence

Escaping debt is only the first step; preventing future debt accumulation requires financial resilience. One proven method to protect against unexpected expenses is building an emergency fund. Financial advisors often recommend saving three to six months’ worth of living expenses in a liquid account for sudden job loss, medical bills, or urgent repairs.

Without an emergency fund, even those who pay off debt can easily fall back into borrowing when unplanned costs arise. For instance, a study by Bankrate in 2023 revealed that 60% of Americans do not have sufficient savings to cover a $1,000 emergency, a common trigger for credit card debt.

Starting small is key: setting aside $500 as an initial “mini-fund” can provide immediate security while people work on larger savings goals. Automating transfers to a dedicated savings account on payday helps maintain discipline without the temptation to spend.

Utilizing Professional Help and Debt Management Programs

For many, self-directed debt repayment is daunting. Seeking professional assistance can provide structured support, tailored plans, and negotiated outcomes. Certified credit counselors, financial advisors, and nonprofit debt management programs offer resources ranging from budgeting help to debt settlement.

Consider the National Foundation for Credit Counseling (NFCC), which reports that clients who enroll in their debt management programs reduce their debt by an average of 40% and become debt-free within three to five years. These plans often consolidate payments, reduce interest rates, and waive late fees, making repayment more manageable.

However, it’s important to choose reputable organizations and avoid scams. Users should verify credentials and understand the terms and potential impacts on credit scores before enrolling.

Future Perspectives: Sustaining Financial Health Long-Term

Regaining control over debt is a transformative process that blends strategic planning, disciplined behavior, and sometimes external support. Looking ahead, maintaining financial health requires continued education, awareness, and adaptability to changing circumstances.

Technology offers promising advances, including AI-driven financial coaching applications and real-time spending alerts that can help individuals stay on track. Millennials and Gen Z consumers are increasingly embracing digital banking tools, with 78% using at least one personal finance app in 2023, according to a survey by Deloitte.

Moreover, recent legislative developments are aimed at increasing consumer protections and accessibility to debt relief programs; for example, proposals to lower student loan interest rates and enhance credit reporting accuracy may ease debt burdens for many.

Ultimately, regaining control from debt empowers individuals not only with financial freedom but with improved mental well-being and opportunities for wealth-building. Embracing a proactive and informed approach toward debt management lays the foundation for a secure and prosperous financial future.

—

By implementing these actionable tips—understanding your debt profile, budgeting wisely, leveraging repayment strategies, building emergency savings, and seeking professional guidance—you set yourself on a viable path out of debt. The journey requires commitment, but with persistence and smart choices, financial control is well within reach.