Investing in Startups: Risks and Rewards

Investing in startups has become an increasingly popular way for individuals and institutional investors to seek out high returns and diversify their portfolios. The startup ecosystem, buoyed by technological innovation and entrepreneurial energy, presents unique opportunities alongside significant risks. Understanding the dynamics of investing in early-stage companies is vital for making informed decisions that balance potential rewards against inherent uncertainties.

Venture capital and angel investing have grown substantially in recent years. According to Crunchbase, global startup funding surged beyond $600 billion in 2021, illustrating the tremendous appetite for early-stage investments. However, the odds of success vary greatly, with industry data suggesting that nearly 90% of startups fail. This reality underscores the importance of evaluating both risks and rewards carefully before deploying capital.

Understanding the Nature of Startup Investment

Investing in startups differs markedly from traditional asset classes such as stocks or bonds. Startups typically are young companies operating with limited track records, innovative but unproven business models, and constrained resources. This makes valuation challenging, and investments illiquid—with capital often locked up for years before any potential payoff.

Startups also operate in highly dynamic markets where competitive landscapes shift rapidly. For example, early investors in Zoom Video Communications in 2017 experienced transformative returns as the company scaled dramatically during the COVID-19 pandemic. Conversely, many other video conferencing ventures from the same period either failed or were acquired at a loss. This volatility highlights the speculative nature of startup investments.

Investors generally rely on different rounds of funding: seed, Series A, B, C and beyond, each stage associated with increasing company maturity and typically lower risk compared to initial seed rounds. Angel investors often participate in seed rounds providing critical early capital, while venture capital firms may join later rounds to fuel expansion.

Risk Factors in Startup Investments

High Failure Rate and Loss of Capital

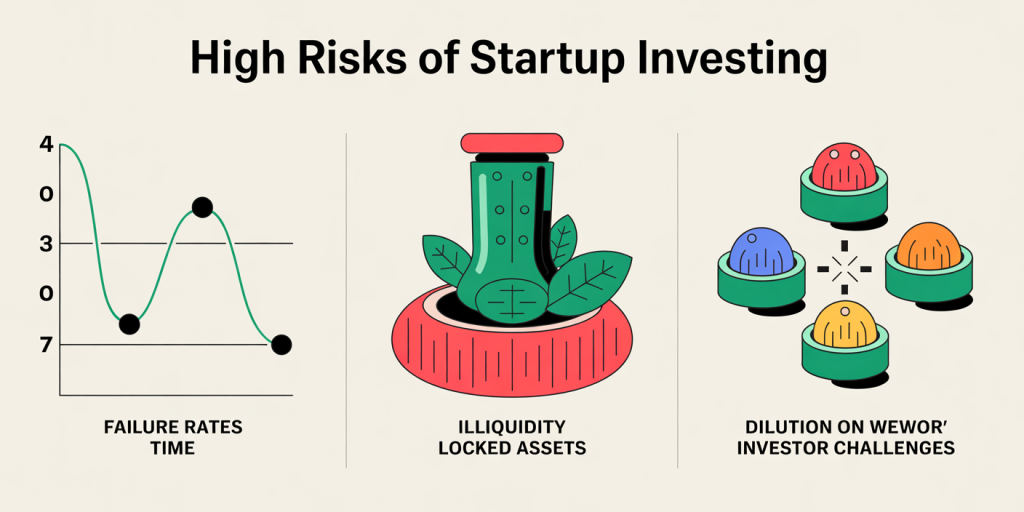

Startups inherently carry a high risk of failure. A study by Startup Genome found that about 20% of startups fail within the first year, 30% within the second year, and approximately 90% fail eventually. The reasons vary—from lack of product-market fit and cash flow problems to management issues and competitive pressures. Such failures often result in complete loss for early investors, especially if the company cannot raise follow-on financing.

For example, Juicero—a startup that raised $120 million for a high-tech juicing machine—shuttered operations in 2017 due to poor market adoption and criticism of its expensive product. Early investors faced total loss, exemplifying the financial risks inherent in backing even well-funded startups.

Illiquidity and Long Investment Horizons

Another significant risk is limited liquidity. Unlike publicly traded stocks, startup shares generally lack a secondary market, requiring investors to wait for an exit event (such as acquisition or IPO) to realize returns. This waiting period can range from several years up to a decade, during which investors’ capital remains tied up and cannot be easily redeployed or sold.

This illiquidity can be problematic particularly if circumstances change, such as shifts in personal financial needs or broader market downturns. For instance, many retail investors who bought shares through equity crowdfunding platforms have expressed frustration at the extended wait times and uncertainty regarding liquidity.

Dilution and Control Issues

As startups raise additional capital in successive funding rounds, early investors face dilution—the reduction of their ownership percentage—unless they participate pro-rata. This dilution can diminish voting power and economic share in future exits. Furthermore, non-institutional investors might have limited influence over company decisions or governance.

Consider WeWork’s dramatic rise and fall: early investors such as Benchmark Capital originally held substantial stakes. Over multiple funding rounds and complex financing structures, however, control eventually shifted, and public market backlash led to significant valuation erosion impacting investors.

Rewards of Startup Investing

Potential for Exponential Returns

Despite the risks, the main reward in startup investing is the potential for outsized returns. Unlike traditional assets offering modest single-digit percentage returns, startups can provide multiples of invested capital. For example, early investors in companies like Airbnb, Stripe, or Uber saw returns often exceeding 10x or even 100x over a decade.

A notable case is WhatsApp, acquired by Facebook for $19 billion in 2014. Sequoia Capital’s $60 million investment in WhatsApp yielded a return estimated at over $3 billion, representing a 50x return. Such successes showcase how high rewards compensate for the associated risks on a portfolio basis.

Diversification Benefits

Including startups in an investment portfolio can enhance diversification by providing exposure to new technologies, disruptive business models, and sectors generally uncorrelated with traditional equities or fixed income. For example, blockchain startups, artificial intelligence companies, and sustainable tech ventures offer access to emerging trends shaping the global economy.

Diversification can also help mitigate the impact of individual failures. By investing smaller amounts across multiple startups, an investor can reduce risk while maintaining the chance to capture the few big winners.

Influence and Strategic Value

Beyond financial gains, some investors—particularly venture capital firms—gain strategic benefits by investing in startups aligned with their core businesses. This can provide early insight into emerging technologies or allow partnerships that create competitive advantages. Corporations often make strategic startup investments to accelerate innovation or secure supply chains.

For instance, Google Ventures’ investments in AI startups have complemented Alphabet’s broader AI capabilities, benefiting both the startups and the parent company’s ecosystem.

Comparative Overview: Risks vs. Rewards

| Aspect | Risks | Rewards |

|---|---|---|

| Capital Risk | High likelihood of loss | Potential for very high returns (10x+) |

| Liquidity | Illiquid, investment locked for years | Illiquidity premiums possible |

| Valuation Uncertainty | Difficult to value early-stage companies | Opportunity to invest at low valuations |

| Control and Governance | Limited investor control and possible dilution | Influence through active involvement possible |

| Market Dynamics | Exposure to volatile, rapidly changing markets | Access to disruptive innovation |

| Diversification | Concentrated risk in few startups | Portfolio diversification benefits |

This table summarizes how startup investing represents a classic risk-versus-reward proposition that requires thorough due diligence and strategic allocation.

Practical Strategies to Navigate Risks

Conducting Rigorous Due Diligence

Investors should carry out deep due diligence encompassing market research, financial analysis, and founder assessments prior to committing funds. Reviewing business plans, competitive landscape, revenue models, and intellectual property helps identify startups with strong growth potential.

Experienced investors often also focus on the founding team’s track record and adaptability. For example, Reid Hoffman, a co-founder of LinkedIn and an active investor, emphasizes the importance of founders’ responsiveness to feedback and agile decision-making in unpredictable markets.

Portfolio Construction and Staging

Because of the high failure rate, investors typically adopt portfolio strategies that spread exposure across multiple startups and stages. Staging investments—providing capital in tranches linked to milestone achievements—allows risk to be managed dynamically.

Angel investors and venture capital funds commonly employ this approach to ensure that funds are allocated efficiently, limiting follow-on investment in poorly performing ventures while rewarding progress in promising ones.

Future Perspectives on Startup Investing

The future of startup investing looks poised for continued evolution due to technological advancements, regulatory changes, and democratization trends. Equity crowdfunding and tokenization via blockchain platforms are opening early-stage investments to a wider range of investors beyond traditional venture capitalists. Data from Fundable and Seedrs indicate that crowdfunding platforms facilitated over $5 billion in startup raises in 2023 alone.

Artificial Intelligence-driven due diligence tools are also becoming more prevalent, enabling more efficient assessment of startups’ potential by analyzing large datasets, market signals, and competitive factors. This could reduce information asymmetry and improve decision-making quality.

Moreover, sustainable and impact investing focus to tackle environmental and social challenges is gaining traction. Startups addressing climate change, clean energy, and social equity are attracting dedicated investor pools, signaling a shift in thematic priorities alongside financial criteria.

However, challenges such as regulatory scrutiny, market saturation in certain tech sectors, and continued uncertainty in macroeconomic conditions may influence the risk landscape. Anchoring investment decisions in careful analysis, diversified portfolios, and adaptability will remain key for capturing opportunities while mitigating downside exposure.

—

Investing in startups offers a unique blend of risk and reward that requires careful navigation but promises the potential for transformative financial outcomes. Successful participation involves understanding the nuances of early-stage companies, adopting risk management tactics, and keeping abreast of evolving market trends. As innovation continues to accelerate globally, startups will likely remain at the forefront of wealth creation for discerning investors willing to embrace uncertainty.