The Power of Compound Interest: How to Make Time Work for You

In the realm of personal finance and investing, few concepts hold as much transformative power as compound interest. Often described as the “eighth wonder of the world,” compound interest allows your money to grow exponentially over time, turning modest savings into substantial wealth. Understanding this financial principle is key not only for investors but also for anyone striving to achieve long-term financial goals such as retirement, buying a home, or funding education.

Compound interest works by generating earnings on both the initial principal and the accumulated interest from previous periods. This cycle of earning interest on interest leads to a snowball effect in wealth accumulation, making the role of time crucial in maximizing returns. In this article, we will explore how compound interest works, practical examples, comparative analyses, and future perspectives to help you harness its power effectively.

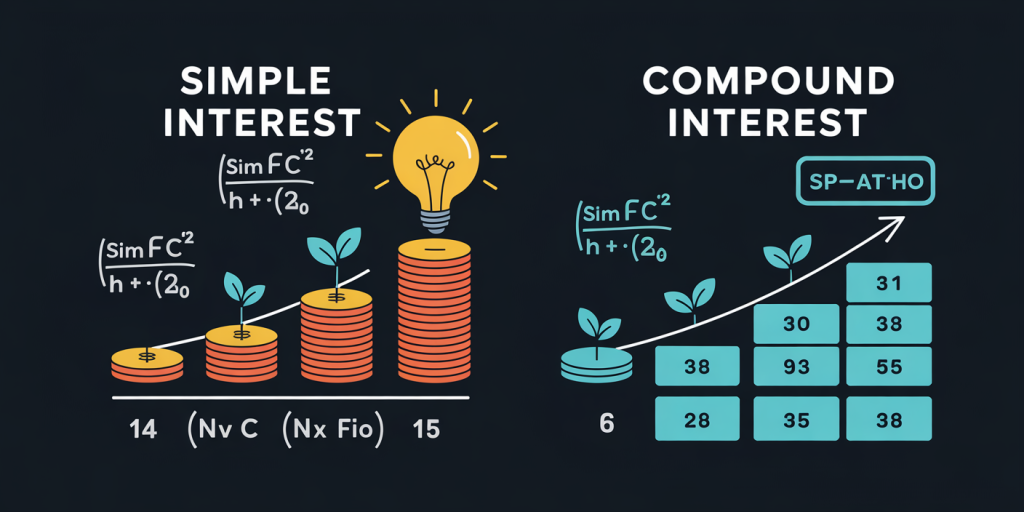

How Compound Interest Differs From Simple Interest

To appreciate the impact of compound interest, it helps first to understand how it contrasts with simple interest. Simple interest is calculated only on the original principal amount, resulting in linear growth. For example, if you invest $1,000 at a simple interest rate of 5% per year, you earn $50 annually, and the total interest earned after 10 years is $500, yielding a total balance of $1,500.

Compound interest, on the other hand, calculates interest on the principal plus any previously earned interest. This means your investment grows at an accelerating pace. Using the same example with compound interest at 5% compounded annually, after 10 years, your total would be approximately $1,629. The extra $129 might seem small in this example, but over longer periods or with higher interest rates, the difference becomes dramatically larger.

| Type of Interest | Formula | Interest Earned After 10 Years on $1,000 at 5% | Total Amount After 10 Years |

|---|---|---|---|

| Simple Interest | P x r x t | $500 | $1,500 |

| Compound Interest | P x (1 + r)^t – P | $629 | $1,629 |

This table illustrates how compound interest accelerates growth even over a relatively short period. The key takeaway is that with compound interest, your returns generate their own returns, which is why it is often termed “interest on interest.” The longer you allow this process to continue, the greater your potential earnings.

Time: The Most Critical Factor in Compounding

Time is arguably the single most influential factor when it comes to harnessing compound interest. The reason is simple: the longer your money remains invested, the more cycles of compounding occur, magnifying both the original investment and the earned interest.

Consider two investors, Jane and Tom, who both plan to accumulate $100,000 for retirement. Jane starts investing $2,000 annually at age 25, whereas Tom waits until age 35 to begin investing the same amount annually. Both invest at a 7% average annual return for 30 years.

| Investor | Starting Age | Annual Contribution | Years of Investment | Final Amount |

|---|---|---|---|---|

| Jane | 25 | $2,000 | 40 | $416,000 |

| Tom | 35 | $2,000 | 30 | $217,000 |

Jane ends up with nearly twice the amount Tom accumulates, despite making the same annual contributions and earning the same rate of return. This example highlights the powerful effect time has on compounding, underscoring why starting early is crucial.

The impact of time also illustrates the disadvantage of delaying saving and investing. Missing even a few years can significantly affect the potential growth of your wealth. Compound interest is not a get-rich-quick scheme; instead, it rewards patience and consistency.

Practical Ways to Maximize Compound Interest Effects

Understanding compound interest is one thing; effectively applying it is another. To maximize the benefits, several strategies can be employed:

Start Early and Invest Regularly

The earlier you start, the more cycles of interest accumulation you gain. Even small amounts invested early can outpace larger sums invested later. Regular contributions ensure that you consistently add to your principal, allowing compounding to generate greater returns.

Reinvest Earnings

Automatically reinvesting dividends or interest payments allows your portfolio to stay fully invested and benefit from compounding continually rather than receiving earnings as cash.

Choose Higher Interest Rates or Returns

While compound interest is powerful at any rate, higher interest rates result in faster growth. However, it’s essential to balance potential returns with acceptable risk levels. For instance, investing in diversified stock markets historically offers about 7-10% average annual returns compared to savings accounts with 1-3%.

Use Tax-Advantaged Accounts

Utilizing retirement or tax-advantaged accounts (e.g., 401(k), IRA, Roth IRA) allows your investments to grow without being eroded by taxes annually, speeding up compounding.

Real-Life Compounding Success Stories

Many investors have turned the power of compounding into remarkable wealth. Warren Buffett, one of the world’s most successful investors, is a prime example. He started investing as a teenager and consistently reinvested his earnings. Buffett’s investment firm, Berkshire Hathaway, has seen compound annual growth rates of roughly 20% over several decades—a staggering feat that has made him a billionaire.

Another everyday example is people who start early with retirement savings. According to a 2023 report by Vanguard, individuals who begin contributing to retirement funds in their 20s have roughly double the accumulation compared to those who start in their 40s, even when contributing the same total sum.

These cases illustrate how compound interest, combined with disciplined investing and time, can create extraordinary wealth—even without extraordinary initial capital.

Common Misconceptions About Compound Interest

Many people misunderstand compound interest, which can lead to missed opportunities. Here are some common myths:

Myth 1: You Need a Lot of Money to Start

Starting with a small amount is better than starting late with a large sum. Thanks to compound interest, consistent small investments can grow significantly over time.

Myth 2: Compounding Only Works with Stocks

Compound interest is a principle of math, not a specific asset. It applies to bank deposits, bonds, mutual funds, and dividends. However, the asset class affects the interest or return rate, which influences growth speed.

Myth 3: The Process Is Linear

Compound interest growth accelerates exponentially, not linearly. This means gains start small but increase rapidly as time goes on.

Understanding these realities allows investors to adopt better financial habits and avoid procrastination.

Future Perspectives: Compound Interest and the Changing Financial Landscape

Looking ahead, compound interest will continue to be a fundamental wealth-building tool, but some evolving factors should be considered:

Inflation Impact

Inflation reduces purchasing power. To truly benefit from compounding, your returns must outpace inflation. For example, if inflation averages 3% and your investment grows at 5%, your real return is only 2%. This is why focusing on real returns is important when planning.

Technological Innovations

Robo-advisors and automated investment platforms have made it easier for people to start investing early and regularly. These technologies facilitate disciplined compounding through dollar-cost averaging and reinvestment.

Regulatory Changes

Tax laws and retirement account regulations evolve, potentially affecting compound interest outcomes. Staying informed and adapting strategies accordingly will help maximize after-tax growth.

Increased Financial Literacy

As financial education improves globally through access to information and digital tools, more individuals can harness compound interest effectively. This democratization of knowledge is expected to play a critical role in wealth accumulation for broader populations.

Diversification and Compound Interest

Diversifying your portfolio across different asset classes can help stabilize returns and reduce risk. A diversified investment approach combined with the power of compounding can lead to more predictable and sustainable growth over time.

—

Compound interest is not just a theoretical concept but a practical, accessible strategy for growing wealth. Its magic lies in the exponential growth fueled by time and consistent investment. By starting early, remaining disciplined, choosing appropriate investment vehicles, and understanding the nuances of compounding, anyone can make time work for them.

Investors and savers who embrace compound interest effectively position themselves for financial success, irrespective of their initial capital. The key is to act now, harness patience, and leverage the exponential potential of compound interest to secure a prosperous future.